sponsored

The global crypto market is expanding steadily despite recent bearish sentiments. Over 119 million people worldwide started owning cryptocurrencies in 2022, marking a 39% rise in total ownership. It reflects a growing demand for alternative payment methods and investment instruments.

More people now believe in the potential of futuristic asset classes like crypto. Particularly since innovators are bringing novel utilities to the table. But the road ahead isn’t all rosy. We must overcome several challenges before crypto-based assets bloom fully.

One key issue is the lack of simple, user-friendly, and stable instruments for beginner and pro investors. For instance, index investing, despite its strong track record in traditional finance, is mostly inaccessible to the crypto community. This exposes investors to market-related risks like high volatility, reducing their scope for diversification and generating suboptimal returns.

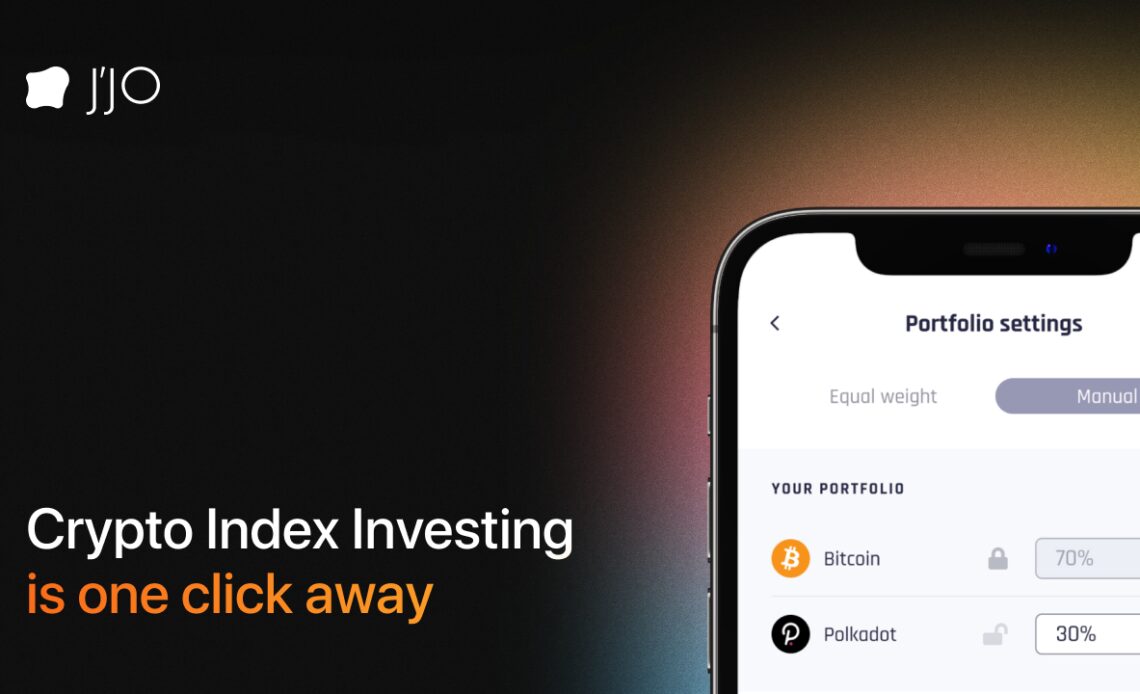

J’JO provides a solution to these problems with its advanced index-based investment service for crypto markets. Besides making crypto investing safer and more accessible, the service helps improve financial planning for investors across the board.

Why crypto needs simpler investment instruments

Cryptocurrencies have shown a meteoric rise in popularity. This is great from the perspective of how this asset class provides value across industries and market segments. From digital currencies to luxury items and real estate, we now have unforeseen revenue streams and transaction methods.

But the journey to using crypto efficiently involves a steep learning curve. It’s pretty different from legacy assets and traditional investments, though they have some basic principles in common. That’s why most crypto investors, with little or no experience, end up putting money in unreliable, half-baked assets. The volatile markets burn them as a result, often demotivating future endeavors.

This can’t go on. Stakeholders of the nascent crypto industry must ensure long-term adoption. And to do that, we must learn some lessons from our traditional counterparts. Offering easier investments for retail users has been a key to the success of legacy financial systems. Crypto has to up its game in this regard.

Some cryptocurrency exchanges and platforms do offer relevant services. But these are mostly hidden from users due to flawed positioning. J’JO thus launched its service for public use in May 2023, as a response to this…

Click Here to Read the Full Original Article at Bitcoin News…