Ahead of The Merge in September, several on-chain datasets indicate a volatile end to proof-of-work on Ethereum.

Will Ethereum rally into Merge Day, or will there be a widespread “sell the news” event?

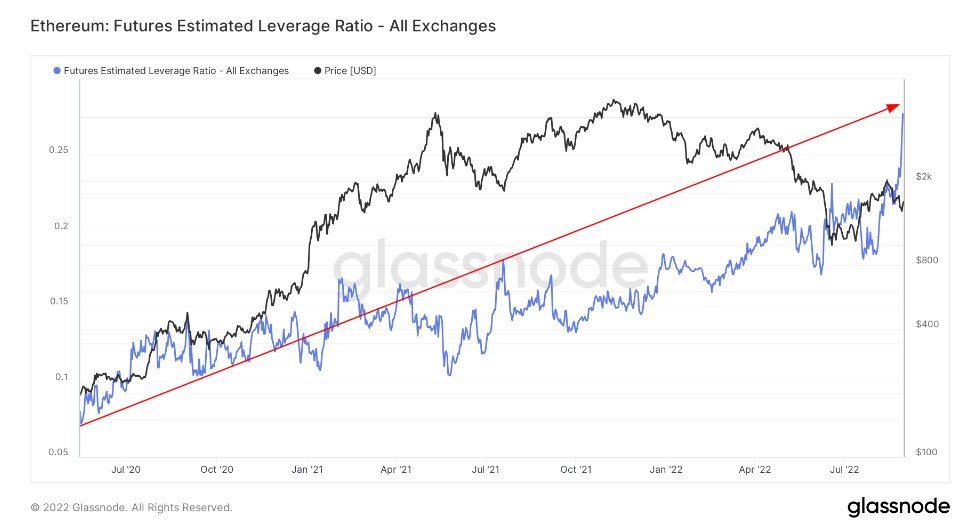

Estimated Leverage Ratios

The volume of leverage within the Ethereum ecosystem has hit all-time highs going into The Merge. The impact can be assessed by reviewing the Estimated Leverage Ratio below. An Estimated Leverage Ratio (ELR) is defined by the open interest ratio in futures contracts against the balance of the corresponding exchange.

As seen from the chat below, there has been a significant uptick in ELR in August. The ELR acts as an Indicator that measures the ratio between open contracts awaiting execution and the reserve of currencies on futures trading platforms. The graph shows the ELR has reached an all-time high of 0.28 — indicating the potential for high volatility should there be large price swings.

As can be seen from the graph, there is little correlation between Ethereum and ELR in terms of price prediction. New all-time highs in ELR have not historically marked either tops or bottoms for Ethereum.

However, the more leverage, open interest, and shorts participating in the market, the higher the likelihood of volatility, as liquidations can cause a snowball effect in either direction.

Funding Rates

Funding rates have been highly negative and correlate with other significant events within the ecosystem, such as Covid-19, Chinese miner bans, and the Terra Luna collapse.

The Merge is likely the catalyst for the negative funding rates since the start of August. Anticipation of The Merge is high for those looking to speculate on price with swing trades around the event.

The chart below highlights the average funding rate percentage set by exchanges for perpetual futures contracts. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…