Investigative journalist James Corbett has recently referred to the ongoing global banking crisis involving SVB, Signature Bank, Credit Suisse and others as the “Panic of 2023,” drawing comparisons to what he views as historical precedents, and pointing ahead to an inevitable and bleak, technocratic surveillance future leveraging central bank digital currencies (CBDCs) should nothing be done to stop it. The answer to the CBDC “total nightmare of monetary control,” as Corbett puts it, is cash, creativity, and to “choose to inform ourselves about agorism and the countereconomy.”

James Corbett on Crisis, CBDCs, Cash, and the Countereconomy

Investigative journalist and freedom activist James Corbett of The Corbett Report, a popular alternative news source based on the “principle of open-source intelligence,” has weighed in recently on the current global banking debacle and its echoes across recent history. Further, he has been cautioning his followers for years about the dangers of giving up their financial freedom, and uncritically accepting burgeoning state-created financial technologies such as central bank digital currencies (CBDCs).

Bitcoin.com News sent Corbett some questions on the topic, asking for his views on the current crisis, its causes, and ways ordinary people can weather the current so-called banking contagion. Below are his responses.

Bitcoin.com News (BCN): In your recent work you’ve drawn similarities between the current banking debacle and the Panic of 1907 and the 2008 financial crisis. How does what we’re witnessing unfold now with SVB, Signature Bank, Credit Suisse, and others, compare to past financial crises?

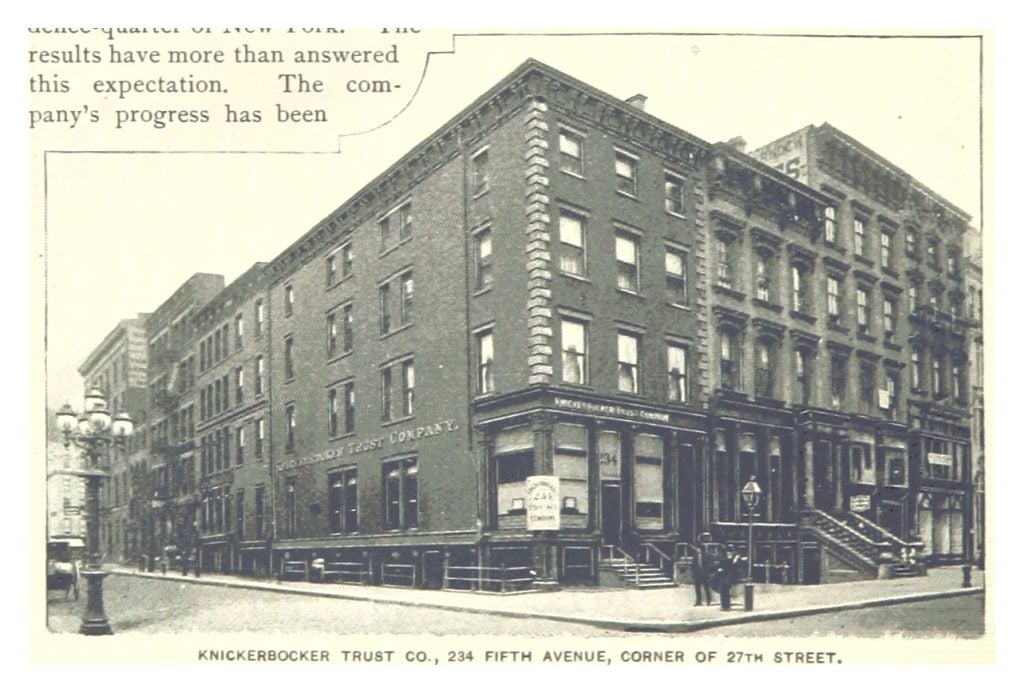

James Corbett (JC): In 1907, a run on Knickerbocker Trust, one of New York’s biggest trust companies, precipitated a bank run and a 50% drop on the New York Stock Exchange. In its official page on the event—dubbed “The Panic of 1907“—the Federal Reserve calls it the “first worldwide financial crisis of the twentieth century.” According to the Fed, the panic was caused by rumours about Knickerbocker Trust’s insolvency and the crisis was ultimately averted by the “legendary actions” of J.P. Morgan, who personally oversaw the bailout of the banking system.

What the Federal Reserve does not note in its official history of the 1907 panic is that—as even Life Magazine conceded decades later—the rumours that sparked the entire affair were themselves planted by George W. Perkins, one…

Click Here to Read the Full Original Article at Bitcoin News…