The United States Internal Revenue Service (IRS) is considering a proposal that would have sweeping consequences for the cryptocurrency industry. Investors should be concerned, because it could significantly impact the way that individuals — both inside and outside America — are allowed to engage with digital assets.

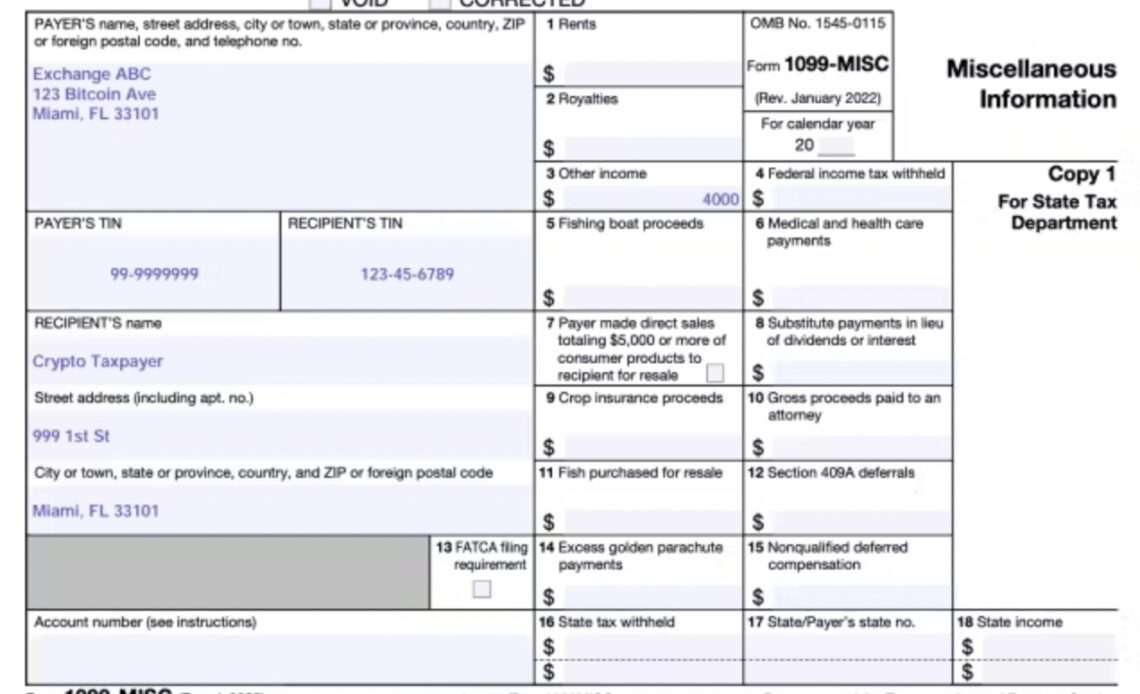

The IRS is proposing an initiative under Section 6045 of the tax code to establish new tax rules for the treatment of cryptocurrency providers. Specifically, the agency is seeking to amend the law to expand the definition of “brokers” to include nearly all crypto-service providers — including, for instance, decentralized exchanges (DEXs) and wallet providers. Those providers would be required to collect personal information from users beginning in 2025, and to begin sending (a still-unreleased) Form 1099-DA to the IRS in 2026. It would be a crypto-focused version of the 1099-MISC.

The IRS’s move to redefine “broker” is not just a regulatory tweak but a fundamental shift that could reshape the entire U.S. cryptocurrency landscape. By potentially including a wide array of cryptocurrency service providers under this definition, the IRS is extending its reach significantly. This expansion means that many more entities involved in digital asset transactions, from wallet providers to small-scale developers, could be required to report user information and transaction details to the government.

For users and investors in the cryptocurrency space, this change could translate into increased reporting and compliance obligations — rolling back the anonymity and flexibility they currently offer users. For service providers, it would require the adoption of new systems and procedures for compliance, requiring them to ask users for their personal information. While the IRS is technically attempting to target American users, service providers would have no way to determine nationalities before harvesting user data.

Related: IRS proposes unprecedented data-collection on crypto users

The move would be a decisive step toward bringing the world of digital assets in line with traditional financial systems in terms of regulatory oversight and transparency. It’s crucial that the average American understand the proposal’s implications, because it represents a significant pivot point in how digital assets are perceived and managed by regulators.

The industry’s response

The industry’s response to these…

Click Here to Read the Full Original Article at Cointelegraph.com News…