The hacker behind the bankrupt cryptocurrency exchange FTX started transferring their Ether (ETH) holding to a new wallet address on Nov. 20. The FTX wallet drainer was the 27th largest ETH holder after the hack but dropped by 10 positions after the weekend ETH dump.

The FTX hacker drained nearly $447 million out of multiple FTX global and FTX.US exchange wallets just hours after the crypto exchange filed for Chapter 11 bankruptcy on Nov. 11. Majority of the stolen funds were in ETH, making the exploiter the 27th largest ETH whale.

On Nov.20, the FTX wallet drainer 1 transferred 50,000 ETH to a new address, 0x866E. The new wallet address then swapped the ETH for renBTC (ERC-20 version of BTC) and bridged to two wallets on the Bitcoin blockchain. One of the wallets bc1qvd…gpedg held 1,070 renBTC while another wallet bc1qa…n0702 held 2,444 renBTC.

FTX Wallet Drainer is now the 37th largest holder of ETH

Dropped 10 places after transferring 50,000 ETH to 0x866E this morning

We’re also continuing to see ETH swapped for renBTC in 0x866E

Wallet currently holds ~1127 renBTC and ~19k ETH pic.twitter.com/sPJjtoWwud

— CertiK Alert (@CertiKAlert) November 20, 2022

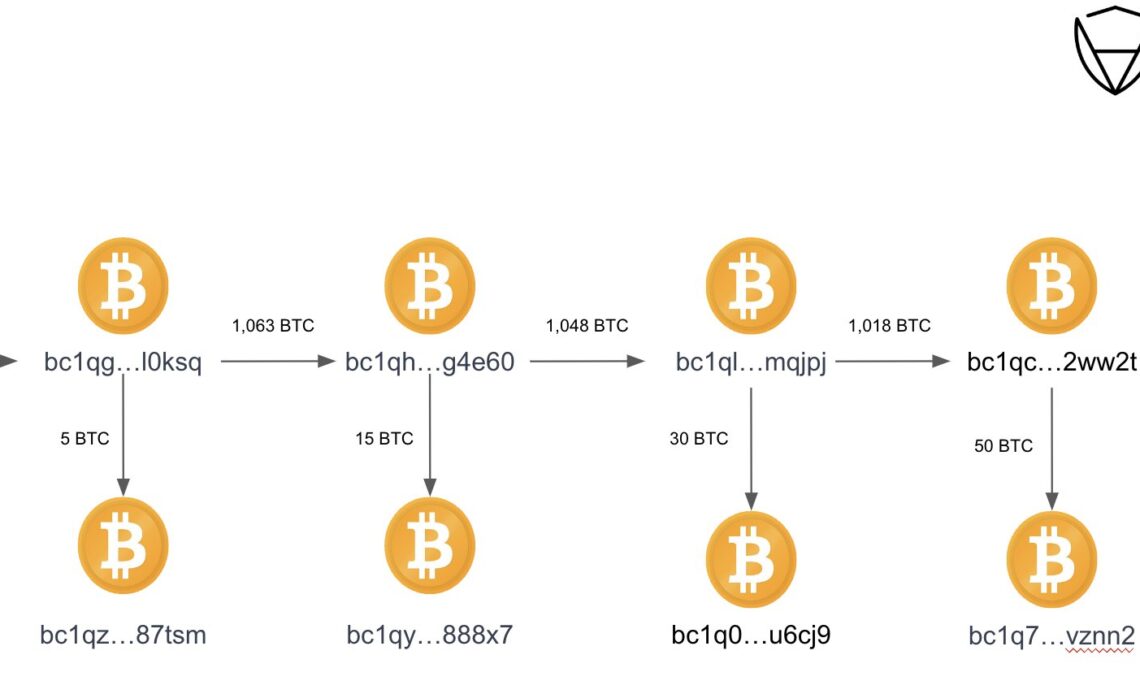

Crypto analytic group CertiK later tracked the bridged renBTC on bc1qvd…gpedg address and found that the address employed a money laundering technique called peel chain to launder the renBTC.

A Peel chain is a technique to launder a large amount of cryptocurrency through a lengthy series of minor transactions. A small portion is ‘peeled’ from the subject’s address in a low-value transfer. These incremental laundered funds are often transferred to exchanges where they can be converted to fiat currency or other crypto assets.

Related: FTX hacker is now the 35th largest holder of ETH

At the time of the FTX hack, there were two parties involved, one black hat that managed to drain $447 million and a white hat that managed to move $186 million of FTX assets to cold storage. However, when Bahaman Securities and Exchange Commission released a notice suggesting they are trying to move assets from the FTX, it raised many eyebrows, with many claiming that the securities regulator was, in fact, the black hat behind the exploit.

Did you see this? Bahamian SEC claims to have (tried to?) “transfer all digital assets” to a digital wallet that they, not FTX, controls. If FTX is the white hat, then isn’t the Bahamian govt the black hat?https://t.co/ddbEmx2nyq

— zkSTONKs (@zkSTONKs) November…

Click Here to Read the Full Original Article at Cointelegraph.com News…