After the FTX collapse, investors are moving large amounts of Bitcoin (BTC) to their self-custody wallets and exiting Ethereum (ETH) to invest in stablecoins, according to data analyzed by CryptoSlate.

Bitcoin retreats to self custody

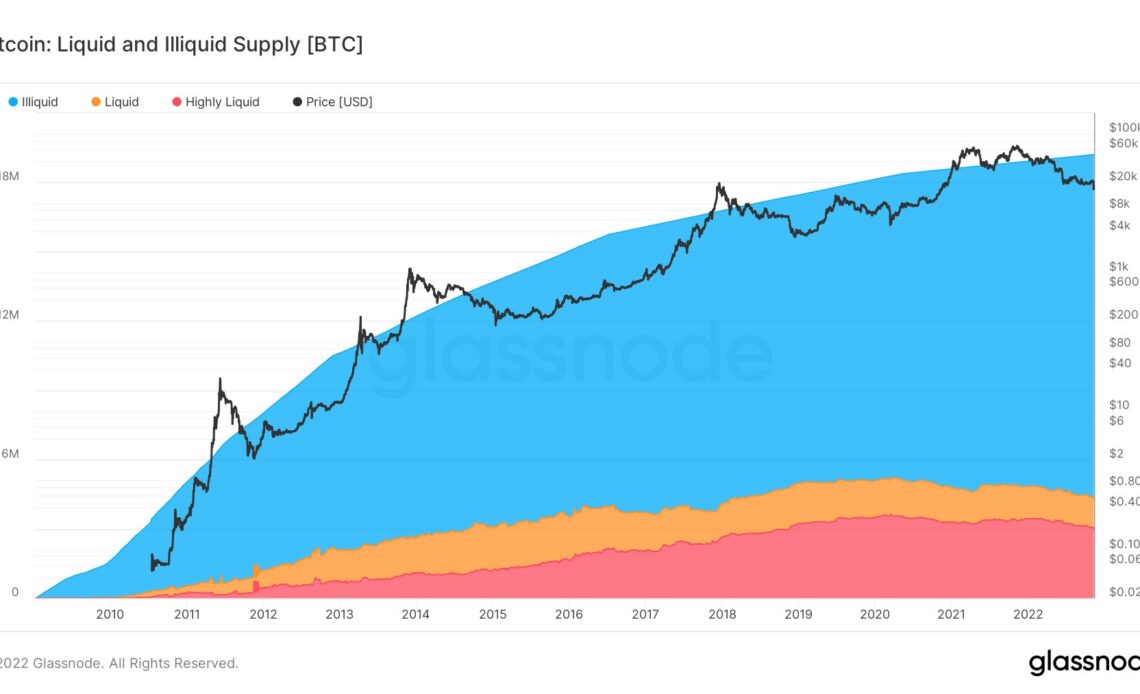

The chart below demonstrates the amount of liquid, illiquid, and highly liquid Bitcoins since 2008.

As of November 2022, the amount of Bitcoins held in self-custody wallets almost reached 15 million. Out of the current circulating supply of 19,204,000, this number shows that 78% of all Bitcoin is held in self-custody.

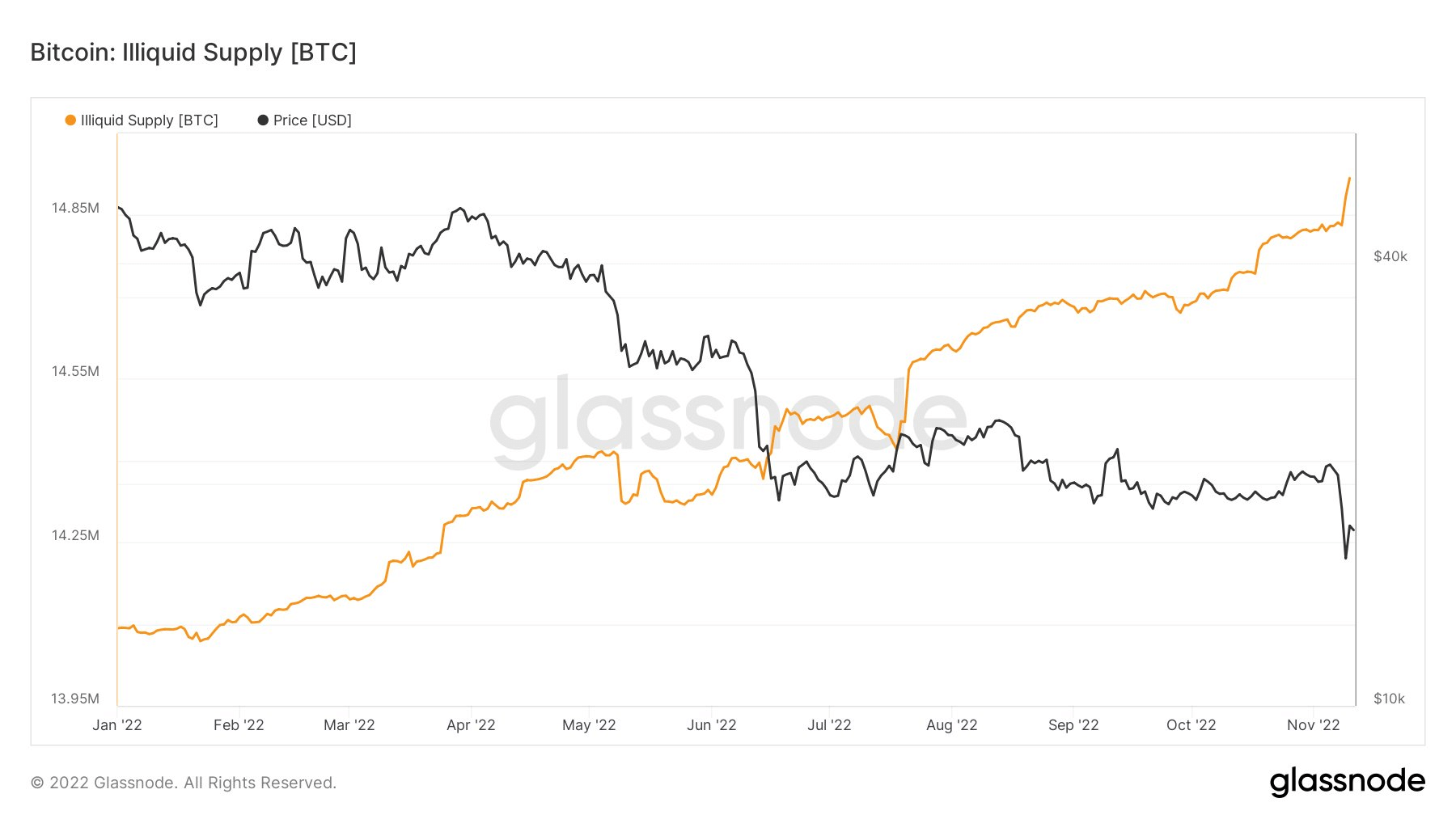

The chart below shows the illiquid Bitcoin supply in more detail since the beginning of the year, and it shows that a sharp increase was recorded this week.

This sharp increase might be the result of the valuable lessons the community learned from the recent events with regard to FTX’s liquidity crisis. Even though FTX recently committed to doing everything it can to provide liquidity, it still abstained from making any promises.

Stablecoins over Ethereum

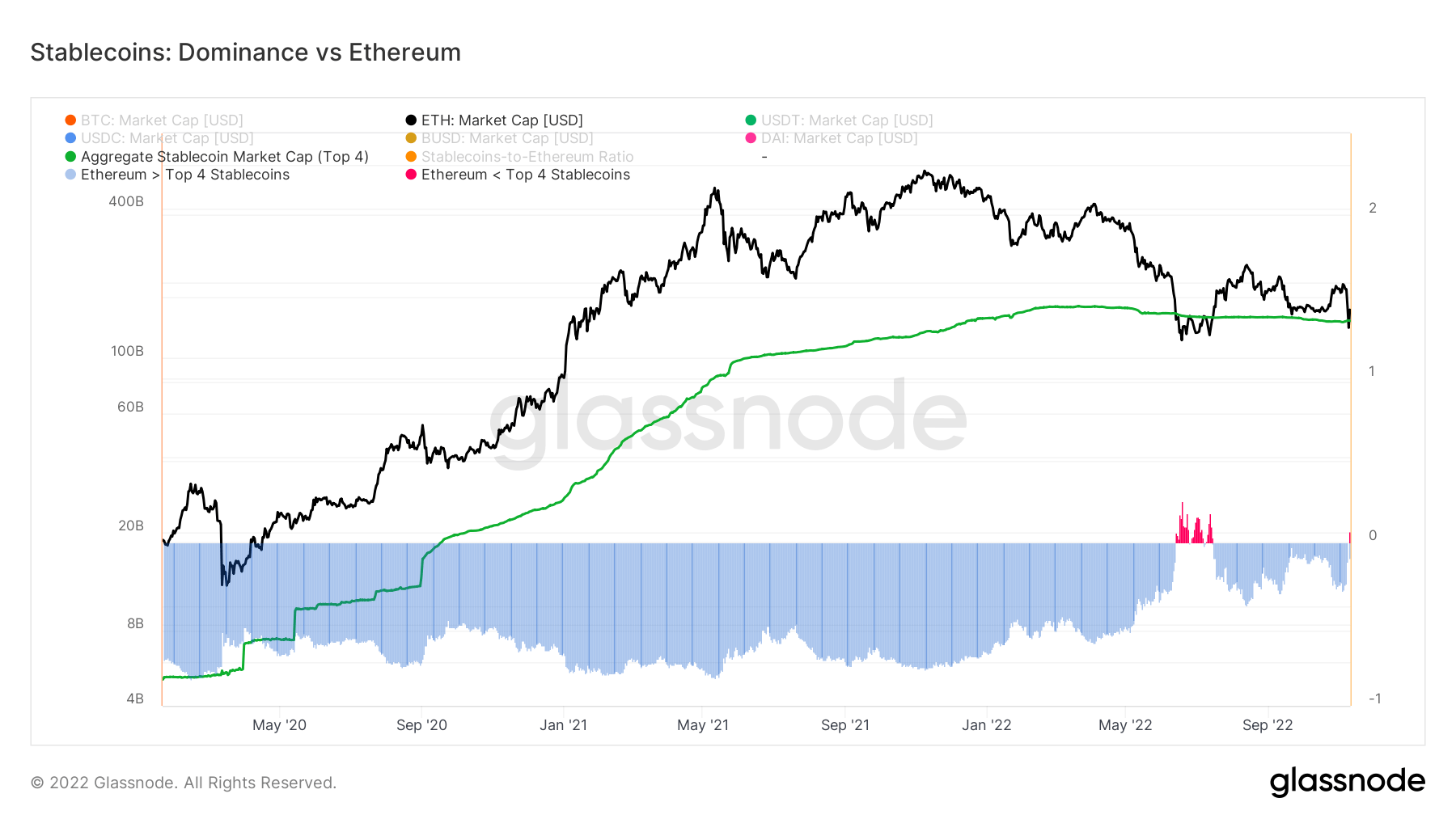

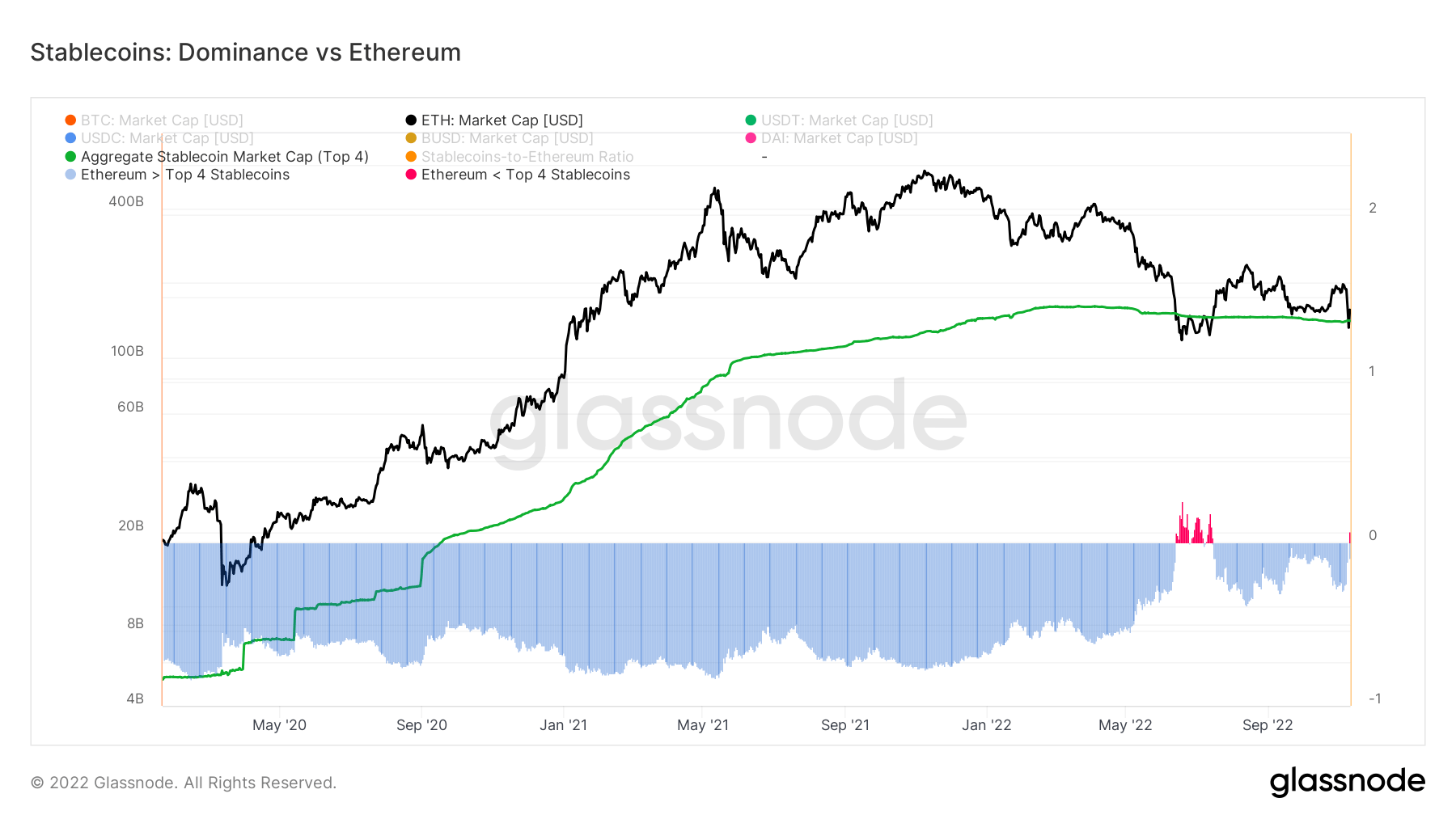

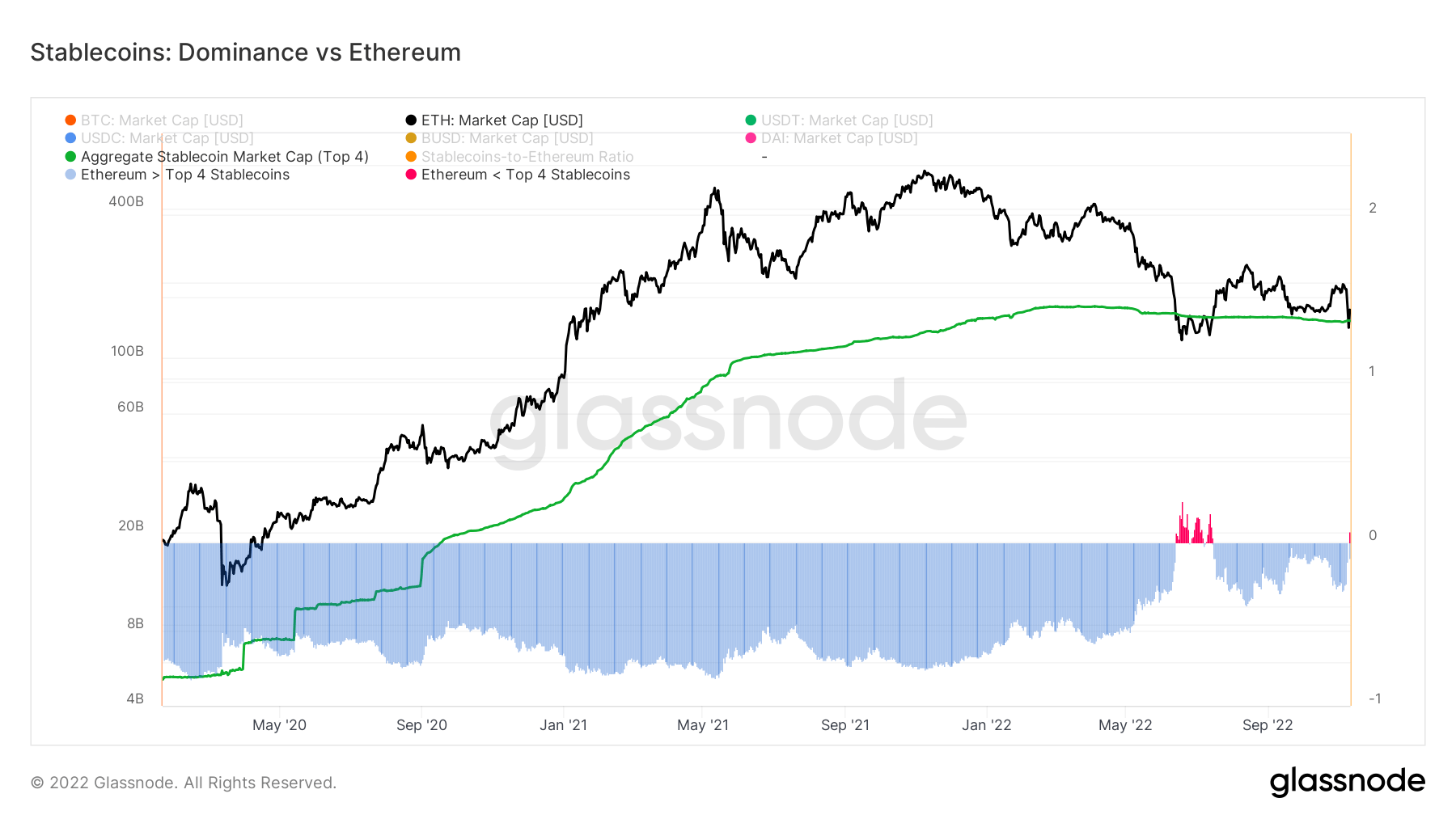

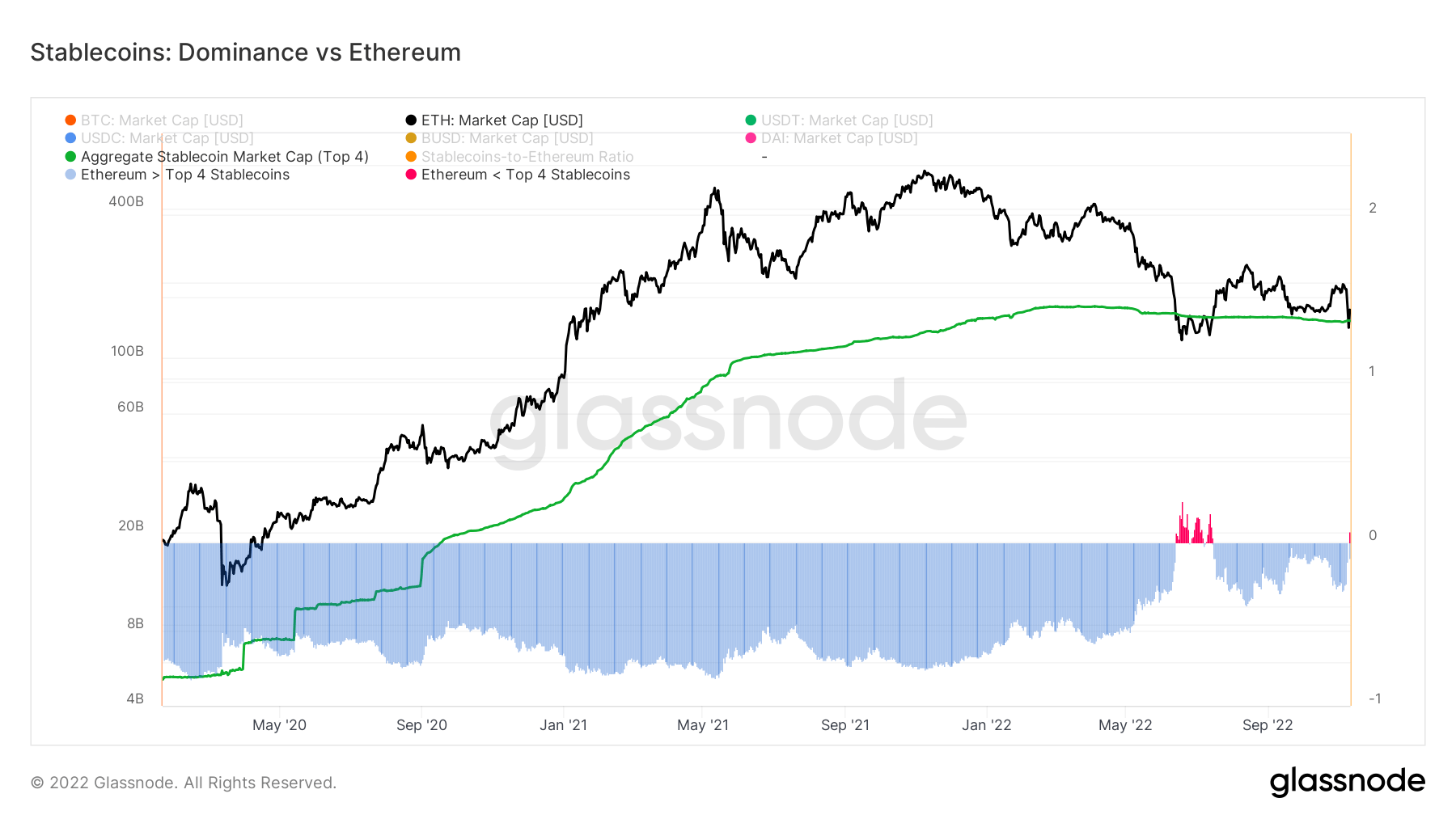

The chart below collects the supplies of the top four stablecoins – Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI)- that are on different blockchains and compares them with the Ethereum Market Cap.

The data shows that stablecoin dominance triumphed over Ethereum dominance as of Nov. 11. This only happened once before in the history of crypto during June 2022, and is a strong indicator showing that investors are moving large funds into stablecoins as Ethereum market cap drops.

Click Here to Read the Full Original Article at Stablecoins News | CryptoSlate…