In the aftermath of the FTX fallout, Bitcoin saw its price drop to a two-year low of $15,000, the exchange’s native token is on its way to becoming essentially worthless, and stablecoins across the market have been struggling to keep their peg.

However, the fall of Sam Bankman-Fried’s empire is far from over. The contagion and second-order effects are yet to be felt and could push the market deeper into the red.

But, what caused the fallout that could set the crypto industry several years back?

CryptoSlate’s in-depth analysis of on-chain data reveals the relationship between FTX and Alameda and how the two companies siphoned money off of each other using Binance as an unsuspecting intermediary.

Alameda and FTX — two sides of the same coin

To understand the scope of Alameda’s ties to FTX we must dig deep into both companies’ token flows.

As the majority of their holdings lay in various stablecoins and altcoins, emitting Bitcoin (BTC) and Ethereum (ETH) from the data paints a much clearer picture as to how the two transacted.

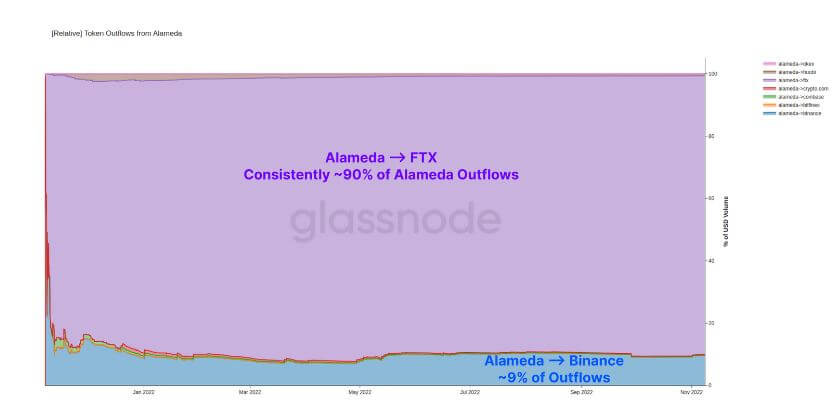

Data analyzed by CryptoSlate showed that, in the past year, over 90% of tokens from wallets associated with Alameda ended up at FTX. Around 9% of all outflows from Alameda ended up at Binance.

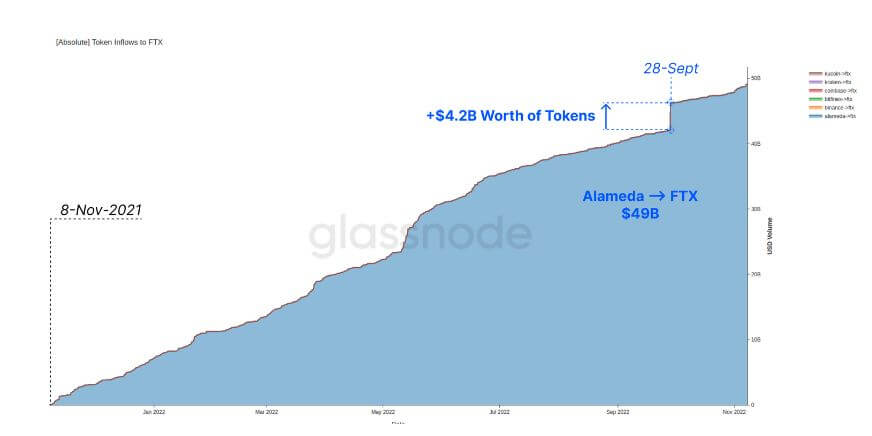

Looking at inflows to FTX reveals the scope of Alameda’s domination. In the period between November 2021 and November 2022, $49 billion worth of various tokens were transferred from Alameda to FTX. The inflows were increasing month on month and saw a vertical jump at the end of September 2022 when over $4.2 billion worth of tokens were sent to FTX.

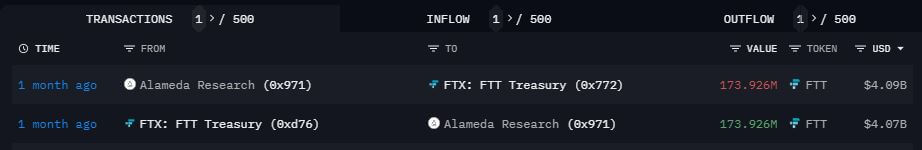

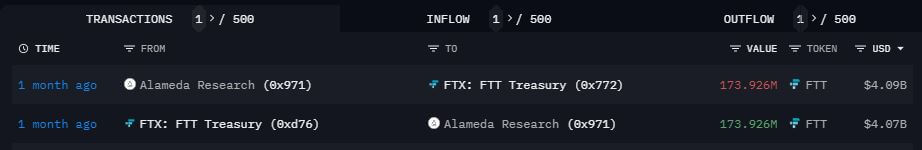

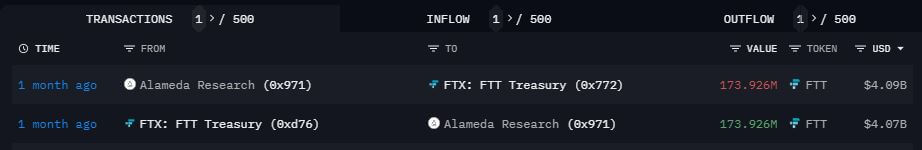

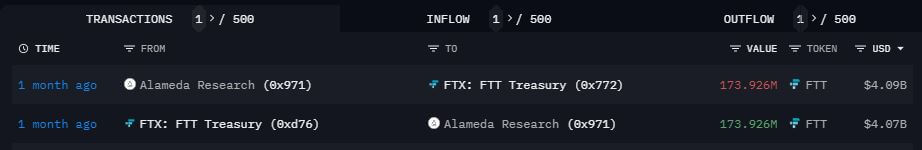

Arkham Intelligence, a cryptocurrency analysis firm, confirmed the inflow in its own reports. The company’s scanner shows an inflow of around $4 billion worth of FTT into the exchange.

And while most of the money going out of Alameda ended up at FTX, it looks like the majority of the money that went back into the trading firm came from Binance. Since last November, around $25 billion worth of various altcoins and stablecoins went into Alameda. Out of the $25 billion, $7.1 billion came from FTX wallets, while over $15.5 billion came from Binance wallets.

The inflows from Binance and FTX dwarf inflows from other exchanges,…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…