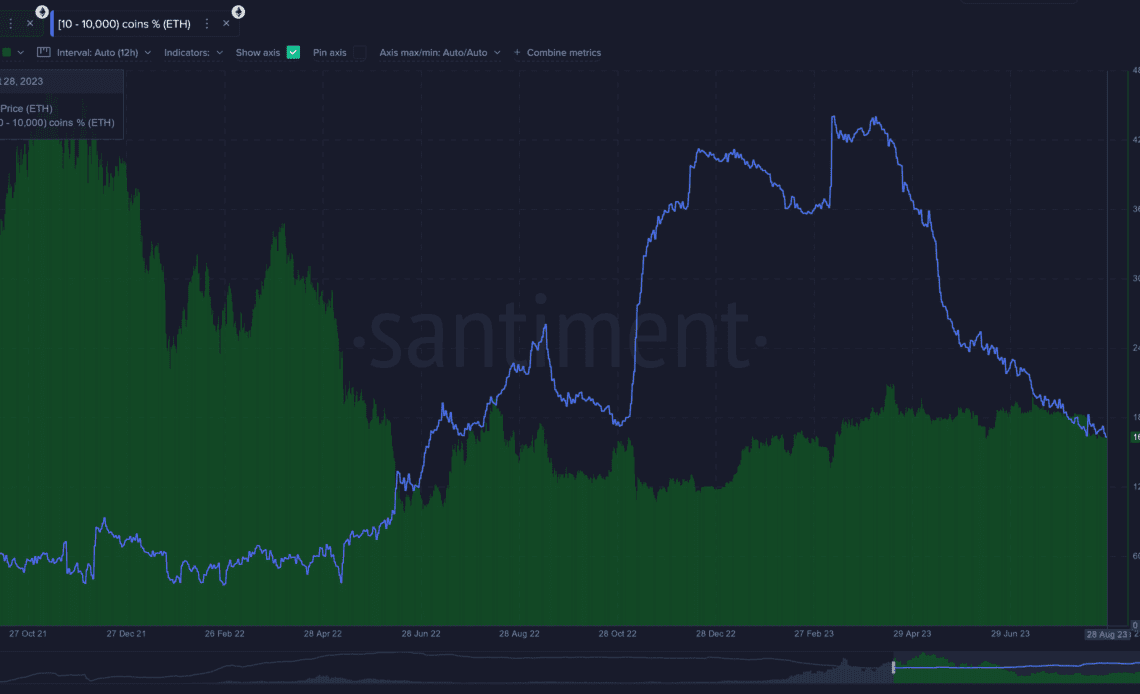

Large holders of Ethereum (ETH) have displayed bearish behavior on the second-largest crypto asset by market cap since around April, according to Santiment.

Santiment’s director of marketing Brian Quinlivan says that addresses holding between 10 and 10,000 ETH turned bearish around April, a contrast to their bullish stance witnessed in the fourth quarter of 2022.

“There has been about a 4-month long dump in supply from addresses holding between 10 and 10,000 ETH.

They really were accumulating significantly at the end of last year, but profit taking from these key tiers happened hard and quickly right as the price was hitting around a 1-year high of approximately $2,120.”

Ethereum is trading at $1,641 at time of writing.

On the likely impact of the sharks and whales’ behavior on the price of Ethereum going forward, Quinlivan says,

“This continued tailslide in supply held by sharks and whales is something we need to monitor. Prices can still rise as they take profit, and their holdings are far from a perfect correlation. But in terms of a signal for an immediate return to $2,000 and above, it certainly isn’t being perpetuated by whales.”

According to Santiment’s director of marketing, Ethereum’s transaction and trade volumes have demonstrated a positive correlation with the price of ETH.

“As far as utility goes, Vitalik Buterin’s [co-creator of Ethereum] project has slumped mightily, with on-chain transaction volume and trading volume seeing a significant drop since peaking in early November of last year.

Though not necessarily a red flag for any asset, this is indicative of the crowd simply showing disinterest during a time when many traders really can’t decide whether the $1,650 price level is overvalued or undervalued.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…