Ether (ETH) has been stuck between $1,170 to $1,350 from Nov. 10 to Nov. 15, which represents a relatively tight 15% range. During this time, investors are continuing to digest the negative impact of the Nov. 11 Chapter 11 bankruptcy filing of FTX exchange.

Meanwhile, Ether’s total market volume was 57% higher than the previous week, at $4.04 billion per day. This data is even more relevant considering the collapse of Alameda Research, the arbitrage and market-making firm controlled by FTX’s founder Sam Bankman-Fried.

On a monthly basis, Ether’s current $1,250 level presents a modest 4.4% decline, so traders can hardly blame FTX and Alameda Research for the 74% fall from the $4,811 all-time high reached in November 2021.

While contagion risks have caused investors to drain centralized exchanges wallets, the movement led to an uptick in decentralized exchanges (DEX) activity. Uniswap, 1inch Network, and SushiSwap saw a 22% increase in the number of active addresses since Nov. 8.

Let’s take a look at derivatives metrics to better understand how professional traders are positioned in the current market conditions.

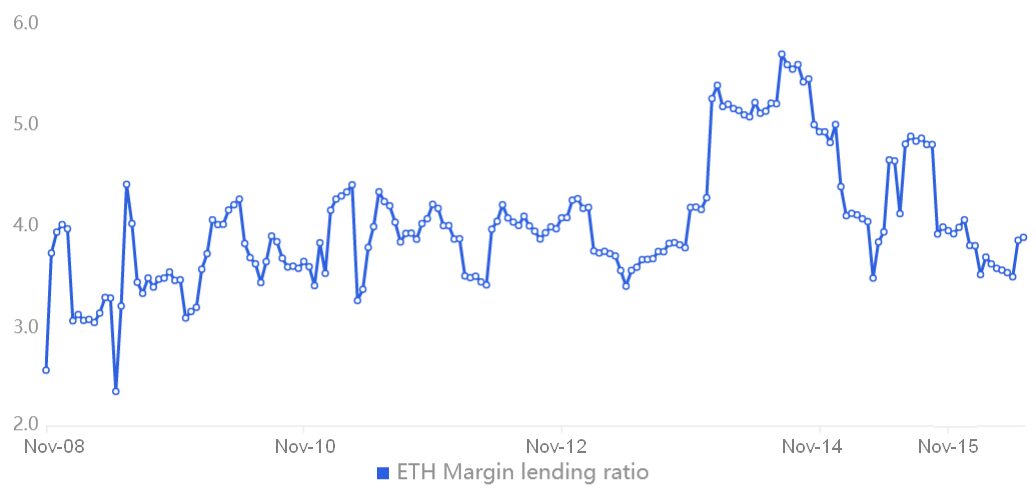

Margin markets show no signs of distress

Margin trading allows investors to borrow cryptocurrency to leverage their trading position, potentially increasing their returns. For example, one can buy Ether by borrowing Tether (USDT), thus increasing their crypto exposure. On the other hand, borrowing Ether can only be used to short it or bet on a price decrease.

Unlike futures contracts, the balance between margin longs and shorts isn’t necessarily matched. When the margin lending ratio is high, it indicates that the market is bullish — the opposite, a low lending ratio, signals that the market is bearish.

The chart above shows investors’ morale topped on Nov. 13 as the ratio reached 5.7, the highest in two months. However, from that point onward, OKX traders presented less demand for bets on the price uptrend as…

Click Here to Read the Full Original Article at Cointelegraph.com News…