[the_ad id="2528"]

[ad_1]

Binance’s native stablecoin — Binance USD (BUSD) — was the third-largest stablecoin pegged to the United States dollar, minted by blockchain infrastructure platform, the Paxos Trust Company, through a transfer of technology agreement between the two firms.

However, on Feb. 13, the New York Department of Financial Services ordered Paxos to stop minting any new BUSD tokens.

The move came just days after the United States Securities and Exchange Commission issued a Wells notice alleging BUSD violates securities laws.

Binance CEO Changpeng Zhao even predicted that regulatory clampdowns would force several other crypto businesses to move away from dollar-pegged stablecoins in the near future, and look for alternative tokens pegged to the euro or Japanese yen.

Zhao’s comments came during a Twitter AMA (ask me anything) session where he said that although gold is a good backing option, most people’s assets are in fiat currencies. He admitted that the U.S. dollar’s dominance in international markets makes it a go-to fiat currency, which is one of the main reasons behind the popularity of dollar-pegged stablecoins. However, regulatory action against such assets might make way for other stablecoins.

Zhao also talked about the role of algorithmic stablecoins, many of which are largely decentralized, and said that these types of stablecoins might play a more prominent role in the crypto ecosystem in the future but are inherently riskier than fiat-backed tokens.

Algorithmic stablecoins are not traditionally collateralized; instead, they use mathematical algorithms often linked to a tokenomics model rather than backed by a real-world asset like the U.S. dollar.

Most algorithmic stablecoin projects use a dual token system: a stablecoin and a volatile asset that maintains the stablecoin’s peg by maintaining the demand and supply system that keeps the stablecoin’s value unchanged. To mint a specific value of the stablecoin, an equal amount of the native token or volatile token is burned.

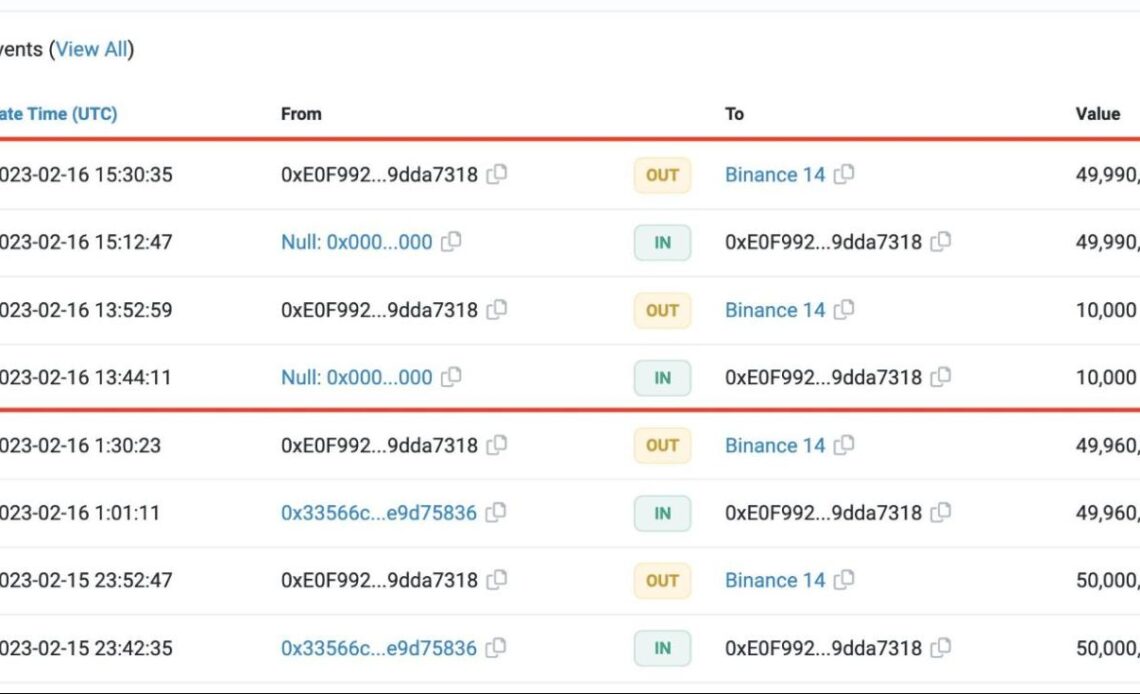

Following the regulatory action against BUSD, Binance turned to several alternative stablecoins, including a few decentralized ones, to fulfill its stablecoin-centered liquidity needs. From Feb. 16–24, Binance minted 180 million TrueUSD (TUSD) stablecoins.

Decentralized stablecoins have a tainted past

Decentralized stablecoins were first popularized in the decentralized finance (DeFi) ecosystem with the creation of Dai…

Click Here to Read the Full Original Article at Cointelegraph.com News…

[ad_2]