Confidence in centralized exchanges seems to have reached a new low following the FTX fallout. Trading volumes across all exchanges have experienced a vertical drop over the weekend, as users rush to withdraw their tokens from custodial wallets provided by the platforms.

Data analyzed by CryptoSlate showed a drastic drop in Bitcoin’s real trading volume. According to Messari, the real trading volume across all centralized exchanges dropped to $2.82 billion on Nov. 12. At press time on Nov. 14, the volumes recovered to $3.14 billion.

This is a sharp drop from the $13.71 billion volume recorded on Nov. 8.

Graph showing the real trading volume for Bitcoin across centralized exchanges (Source: Messari)

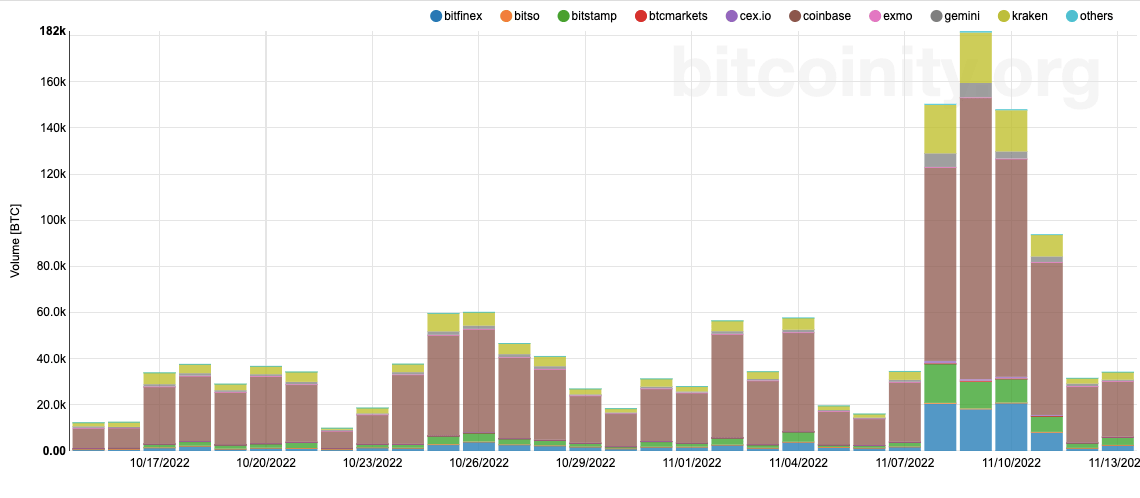

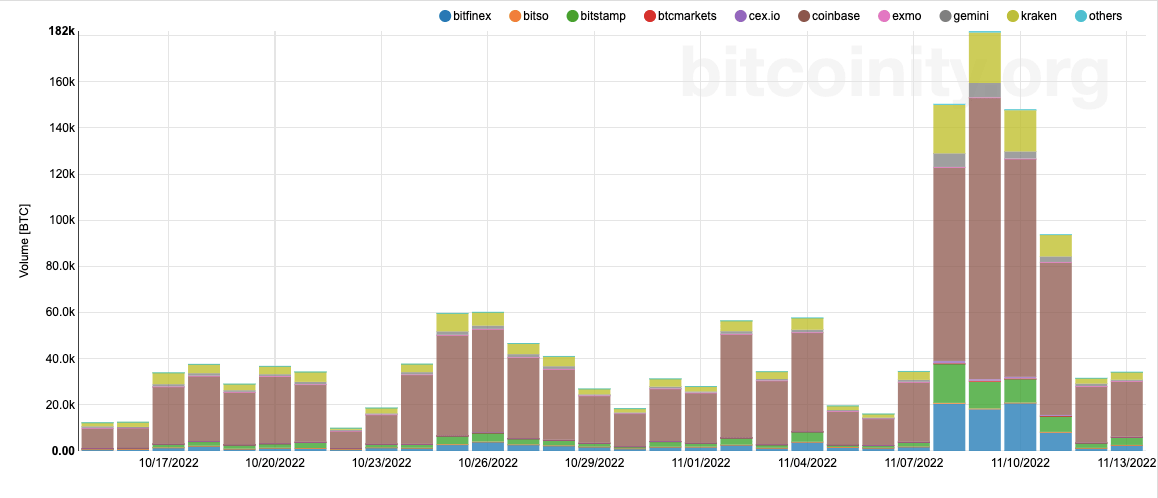

Looking at individual exchanges further confirms this trend.

Bitcoin trading volumes across 10 large centralized exchanges, excluding Binance, OKEx, and BitMEX, decreased almost fivefold in the span of a few days, dropping from around 182,000 BTC per day on Nov. 9 to around 38,000 BTC on Nov. 13.

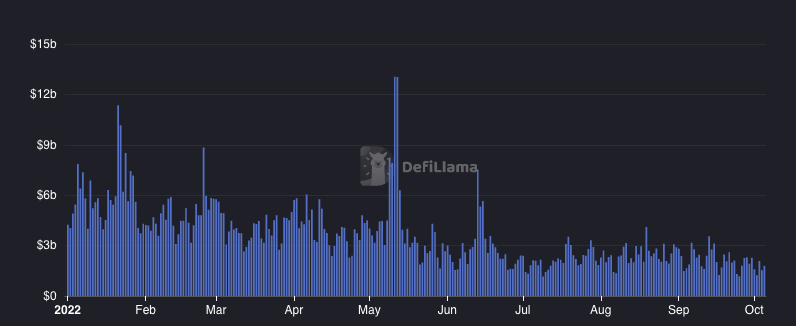

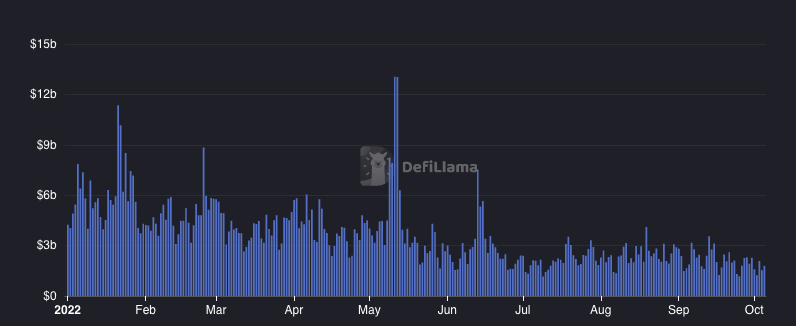

All of the volumes wiped from centralized exchanges seem to have transferred to decentralized ones. DEXs saw a vertical spike in trading volume over the weekend, reaching almost $12 billion. According to DeFi Llama, trading volume across all decentralized exchanges reached $11.93 billion on Nov. 10, a sharp jump from the $2.92 billion recorded on Nov. 7.

Out of all the large DEXs, Curve led the way seeing its trading volume increase by 334% in the span of a week. However, with $1.3 billion recorded on Nov. 12, Uniswap is the leader when it comes to sheer trading volume.

It’s still too early to tell what caused the quick shift in volume. The market crisis caused by the FTX fallout put the security of user funds into question and could have pushed retail traders away from centralized exchanges. The more transparent and decentralized nature of automated smart-contract-based trading platforms like Uniswap and Curve could come as an antidote to the retail market damaged by the FTX fiasco.

Any spikes in trading volumes on large exchanges could be led by institutional investors, especially on exchanges serving large enterprise clients like Coinbase.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…