On Oct. 25, 2022 — about two weeks before the collapse of the world’s third-largest cryptocurrency exchange, FTX — prominent DeFi architect Andre Cronje published a foreboding article with a chilling warning on the state of centralized cryptocurrency exchanges:

“Remedies under the current regulatory regime are ineffective. Most investors sign away their rights to their crypto in voluminous terms and conditions of crypto-exchanges and many will (at best) rank as unsecured creditors should these exchange services be liquidated. Crypto exchange and crypto investment service providers are essentially operating as banks, but without the safeguards and regulation which banks are required to follow.”

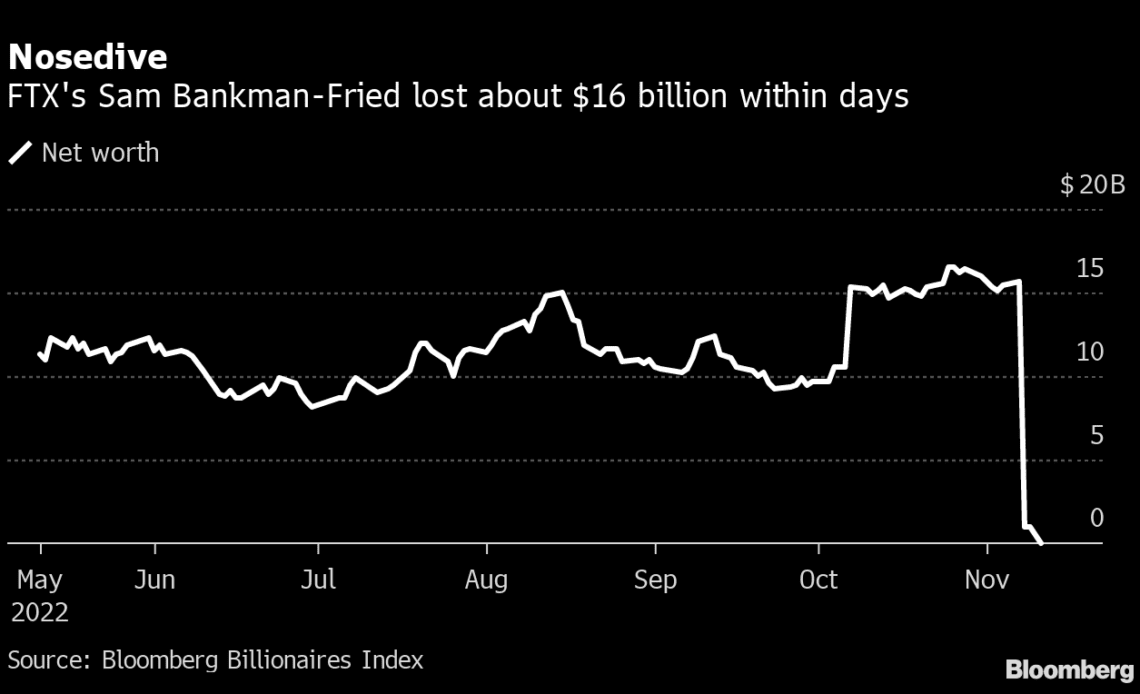

What happened afterward is history. With the abrupt downfall of FTX, customers suddenly discovered that despite all previous guarantees, their assets had been locked as the defunct exchange filed for bankruptcy amid an $8 billion shortfall — the consequence of senior executives siphoning customer assets to trade in related hedge fund Alameda Research. Even though the new management claims they have recovered some customer assets, clients’ funds still remain frozen in bankruptcy proceedings, with no end in sight and heavy legal fees to follow.

In the aftermath, the crypto community has raised serious concerns regarding the state of CEXs. Demands such as proof of assets and liabilities, segregation of customer funds, and voluntary registration as broker-dealers have echoed in the industry. That said, haven’t CEXs come this far by making an effort to legitimize their operations? Here’s why the issue is more complicated than meets the eye.

Why not just get regulated?

Jack Graves, a teaching professor at Syracuse University, tells Magazine, “To my knowledge, there is nobody acting as an exchange of cryptocurrencies and digital assets in the U.S. that is registered with the SEC. Instead, they simply stated that they don’t trade securities. And that’s a critical difference.”

Graves explains that while exchanges such as Coinbase are licensed money transmitters, they are not broker-dealers. “As soon as you talk about broker-dealers of securities, that triggers a bunch of disclosure and custody requirements,” Graves states. “I happen to use Fidelity as my brokerage company, and if Fidelity goes bankrupt,…

Click Here to Read the Full Original Article at Cointelegraph.com News…