Bitcoin (BTC) trended toward $24,000 at the Feb. 16 Wall Street open after fresh macroeconomic data from the United States overshot estimates.

Hot U.S. PPI data “rattles” markets

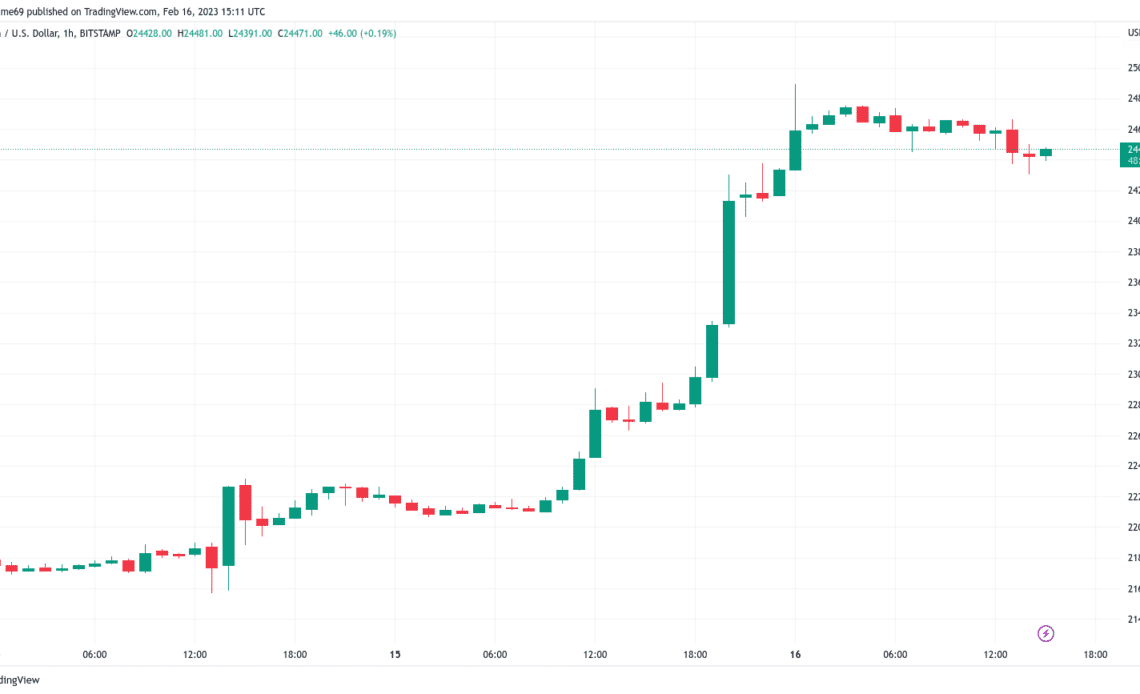

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD retracing some of its latest gains on the day, trading at around $24,400 on Bitstamp at the time of writing.

The pair had hit $24,895 on Bitstamp overnight, marking its highest levels in six months as a surprise rally appeared to catch many traders off-guard.

Over the two days to Feb. 16, $80 million in short positions were liquidated on Bitcoin alone, with $65 million coming on Feb. 15 — the most in a single day since Jan. 20.

The U.S. Producer Price Index (PPI) print for January nonetheless extinguished some of the excitement on risk assets as it showed prices increasing more than expected on a year-on-year basis.

The S&P 500 and Nasdaq Composite Index were both down 1.1% at the time of writing.

“Some signs of economic weakening in today’s macro data,” investment research resource Game of Trades wrote in part of a Twitter reaction, also noting that unemployment data had come in below the expected 200,000 claims for the week.

Markets rattled by hot US PPI data. US PPI for Jan was hot (hotter than the CPI from a few days ago), w/headline +0.7% MoM vs +0.4%, PPI YoY at 6% vs 5.4% expected. Core US PPI disappointed as well w/+0.6% MoM vs +0.2% expected, 4.5% YoY vs 4% expected. pic.twitter.com/IE7SWvcM8Q

— Holger Zschaepitz (@Schuldensuehner) February 16, 2023

In step with declining equities, the U.S. dollar index (DXY) showed renewed strength, climbing above 104.1 to its highest levels since the first week of the year.

“Still going perfectly as expected, so far we’re seeing a D1 downtrend break and flip, eyes on D1 200 EMA in the 104.5-104.7 area as discussed past couple of weeks,” popular trader Pierre wrote in an update on events.

What’s in a death cross

Bitcoin faced key moving averages of its own, meanwhile, in the form of the 50-week and 200-week trend lines, these having just printed their first-ever “death cross” in a warning to bulls.

Related: Why is Bitcoin price up today?

For Cointelegraph contributor Michaël van de Poppe, however, there was reason not to pay too much attention to the phenomenon following the 2022 bear market.

“The Death Cross…

Click Here to Read the Full Original Article at Cointelegraph.com News…