A leading crypto analytics firm says that key indicators are signaling Bitcoin (BTC) is on the verge of a bearish turn after an extended rally.

In a new blog post, Santiment says five indicators are flashing bearish for Bitcoin even though the king crypto is making moves closer to the $30,000 price level.

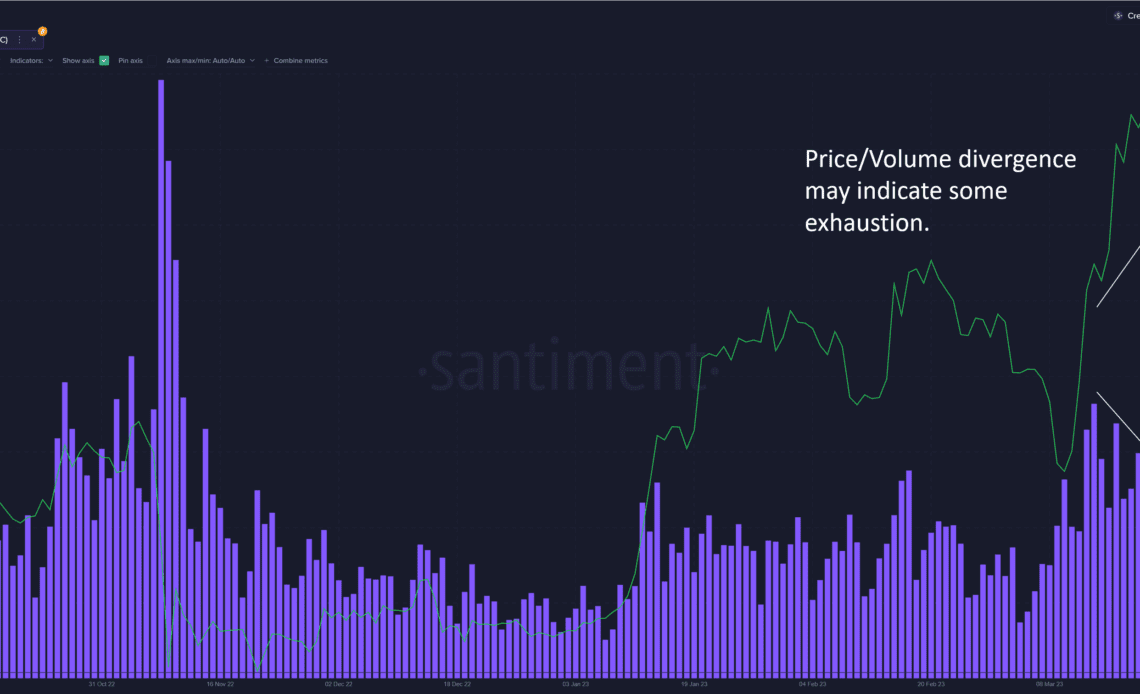

According to Santiment, the trading volume is cooling off.

“The recent rally saw pretty decent trading volume coming in at the start, which is a healthy sign. However, things started to slow down a little as we inch higher. Now we are observing a divergence in Price and Volume, which usually isn’t a good thing as it is signaling that there’s exhaustion in the price action.”

Next, Sentiment says that the Social Volume and Social Dominance indicator is at a high level, which historically indicates the top of a price rally has arrived.

“BTC’s Social Volume and Social Dominance are at its highest level in a year, indicating that the crowd is getting somewhat excited. This usually precedes a local top.”

According to Santiment, the third bearish indicator is that long-term holders of Bitcoin are starting to become active again.

“Since mid-March, we saw two such spikes, between 2,800 and 3,000 BTC that are pretty long-term (five years) being activated. Could it be due to the crypto crackdown or CTFC [Commodity Futures Trading Commission] vs. Binance case? Whichever the case, seems like some whale is probably feeling a little jittery about everything that’s going on.”

The second to last indicator signaling bearishness is the activity of Wrapped Bitcoin (WBTC) borrowing on lending and borrowing decentralized finance (DeFi) protocol Aave (AAVE), according to the analytics firm.

“Currently, we are seeing cautious borrowing of WBTC at this price range, nothing too insane yet but looks like folks have started to short.”

Lastly, Santiment says Bitcoin’s market-value-to-realized-value (MVRV) ratio, which seeks to capture market bottoms and tops based on the average profitability of all Bitcoin holders, is indicating that the Bitcoin rally may soon come to an end.

According to Santiment, the MVRV ratio may be forming a similar pattern seen in 2019.

“If history is to repeat, then, we might just see a sharp spike marking a local top and a dreadful bleed out like 2019. Granted, macro conditions today are very very different from that of 2019. It still remains…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…