Bitcoin set a new all-time high yesterday, reaching $93,483, continuing its impressive rally without significant setbacks. Over the past nine days, the crypto leader has surged with minimal dips, not falling more than 5% during this bullish phase. This relentless price action has drawn widespread attention as Bitcoin defies expectations and resists any notable pullback.

Related Reading

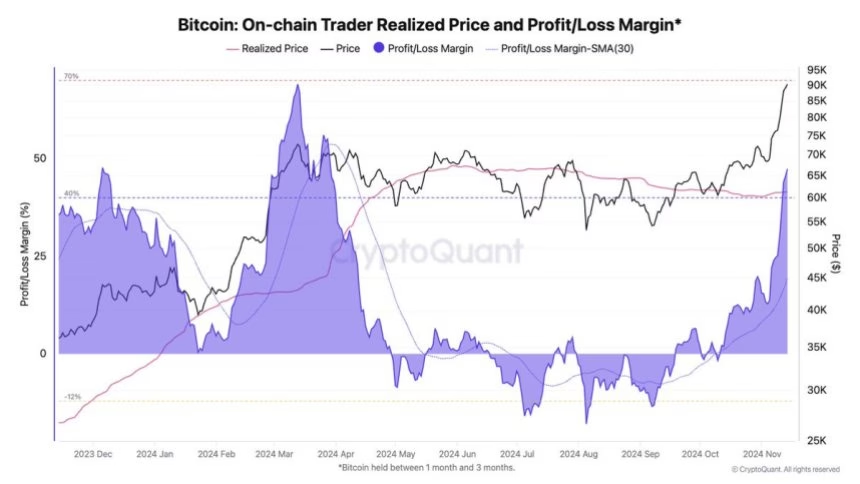

Key data from CryptoQuant reveals that traders’ unrealized profit margins are climbing, indicating that the market may be nearing a short-term peak. High unrealized profit levels typically signal that a correction could be on the horizon as investors look to secure gains. However, given the current strength of Bitcoin’s price action, the timing and scale of any correction remain uncertain.

With Bitcoin’s price momentum showing few signs of slowing down, the coming days will be crucial in determining whether the market can sustain these levels or if a healthy retrace is in store. Investors are closely watching for potential entry points and key support levels, knowing that even minor dips could trigger strong buying interest as Bitcoin’s bullish phase persists.

Bitcoin Strong Move About To Pause?

Bitcoin’s price action has been remarkable, surging 38% since the U.S. election and capturing widespread attention with its unrelenting bullish momentum. However, this aggressive rally may be approaching a temporary pause, as data hints at a potential correction.

CryptoQuant’s head of research, Julio Moreno, recently shared a compelling chart highlighting Bitcoin traders’ unrealized profit margins, which have reached 47% — a level that has often preceded price pullbacks.

High unrealized profit margins can indicate that traders are sitting on significant gains, raising the likelihood of profit-taking that could trigger a market cooldown. Moreno’s analysis notes that this metric tends to correlate with a heightened risk of a correction when it surpasses certain thresholds. For instance, prior peaks in March reached 69%, while December 2023 saw unrealized profits hit 48%, both instances that led to notable corrections shortly after.

Still, the current 47% level suggests that, while caution may be warranted, Bitcoin’s bullish phase still has room to run. Past cycles demonstrate…

Click Here to Read the Full Original Article at NewsBTC…