Analysts forecast a year-over-year increase of 6.5% in the U.S. Consumer Price Index (CPI) for December 2022 — with the Bureau of Labor Statistics’ official data releasing Jan. 12 — but 2023 could bring some upside as investor Michael Burry expects CPI to move lower this year but warned that any subsequent pivot on interest rates to stimulate economic activity would trigger a second inflationary spike.

November 2022’s actual CPI came in at 7.1%, less than the forecasted 7.3% rate. The better-than-expected result led to a jump in crypto prices during the announcement, with Bitcoin posting an immediate spike to $18,000 at the time.

Throughout this bear market, CPI data and interest rate announcements have been significant catalysts to crypto price volatility before, after, and during announcements. But to what extent?

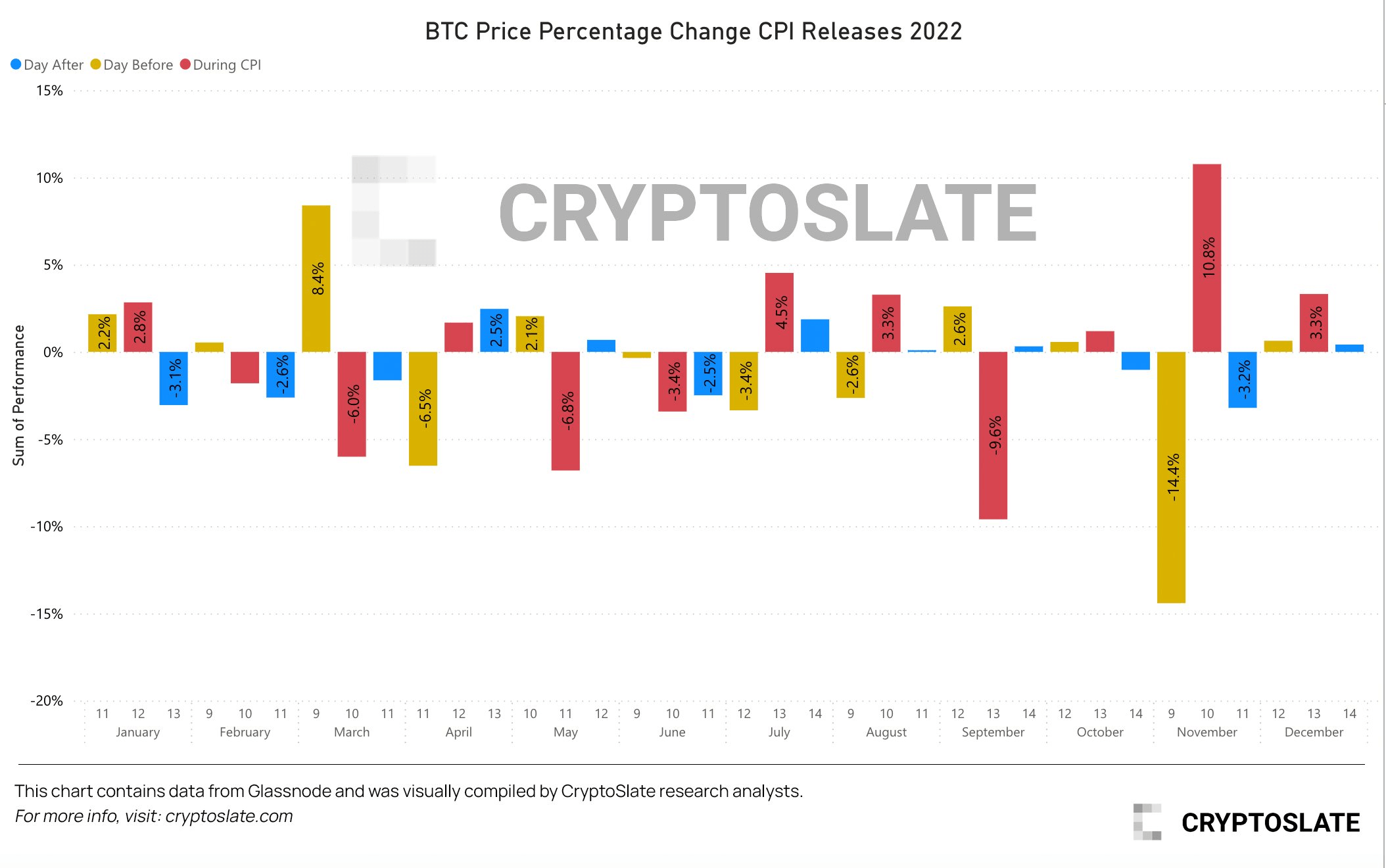

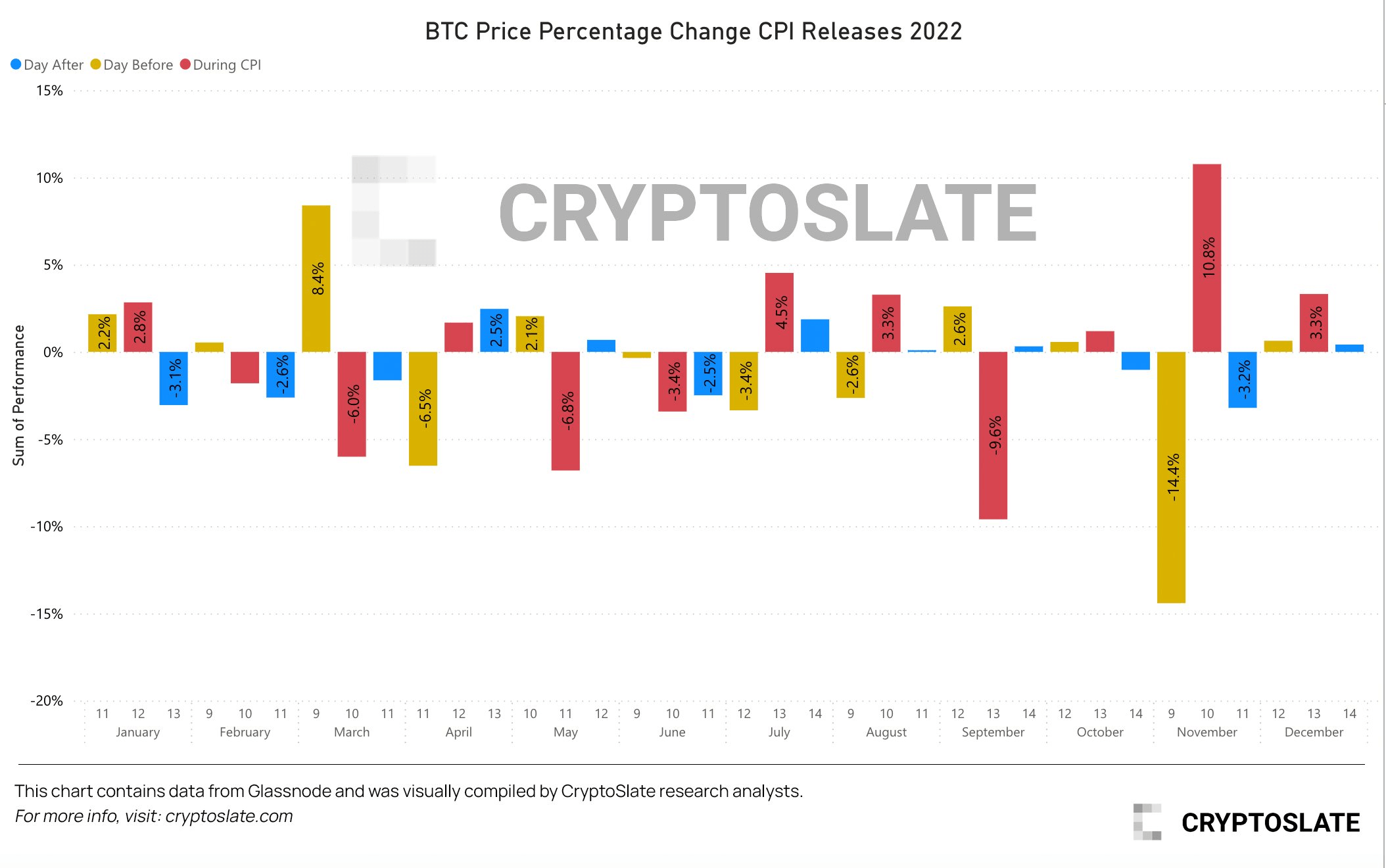

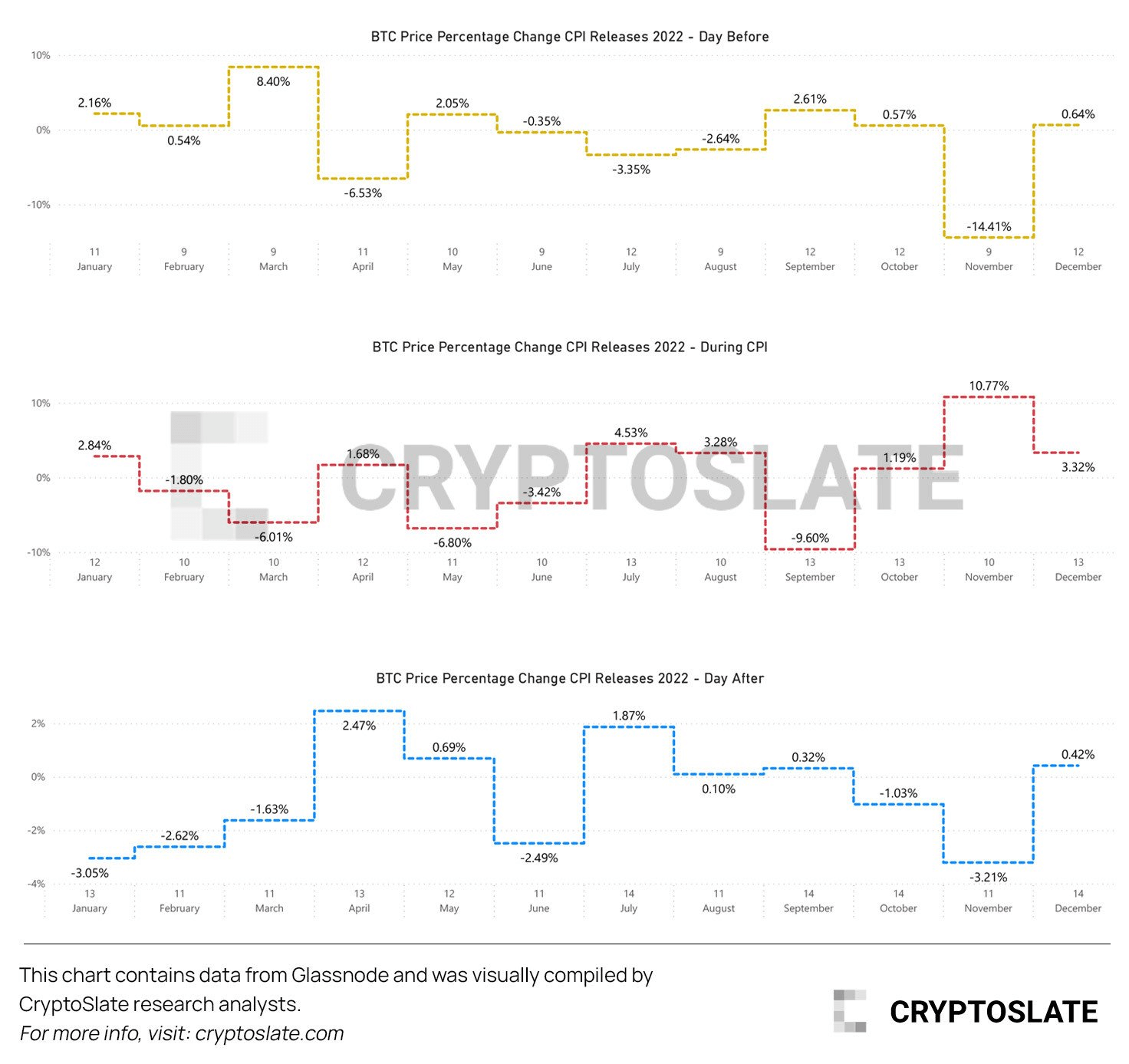

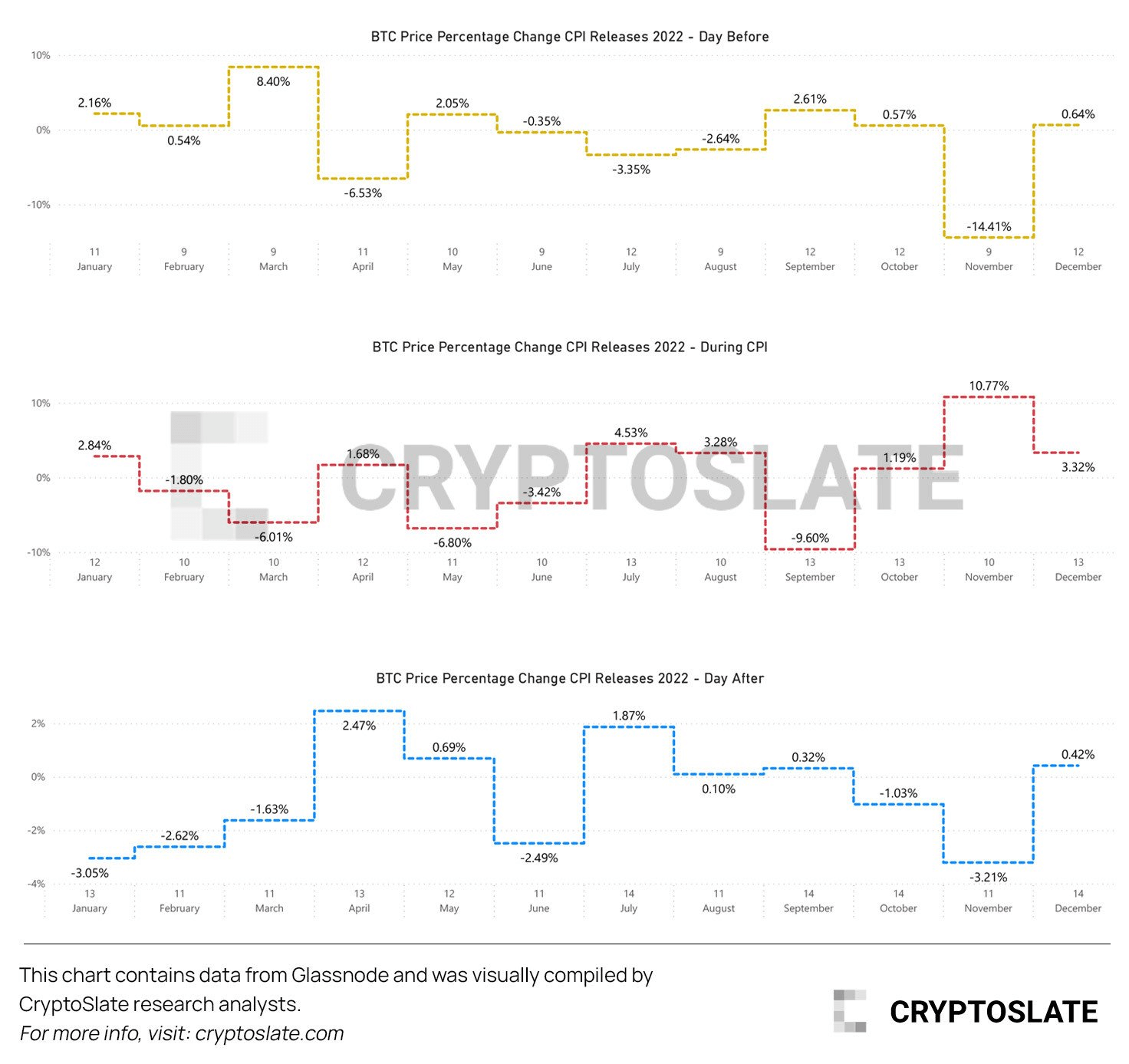

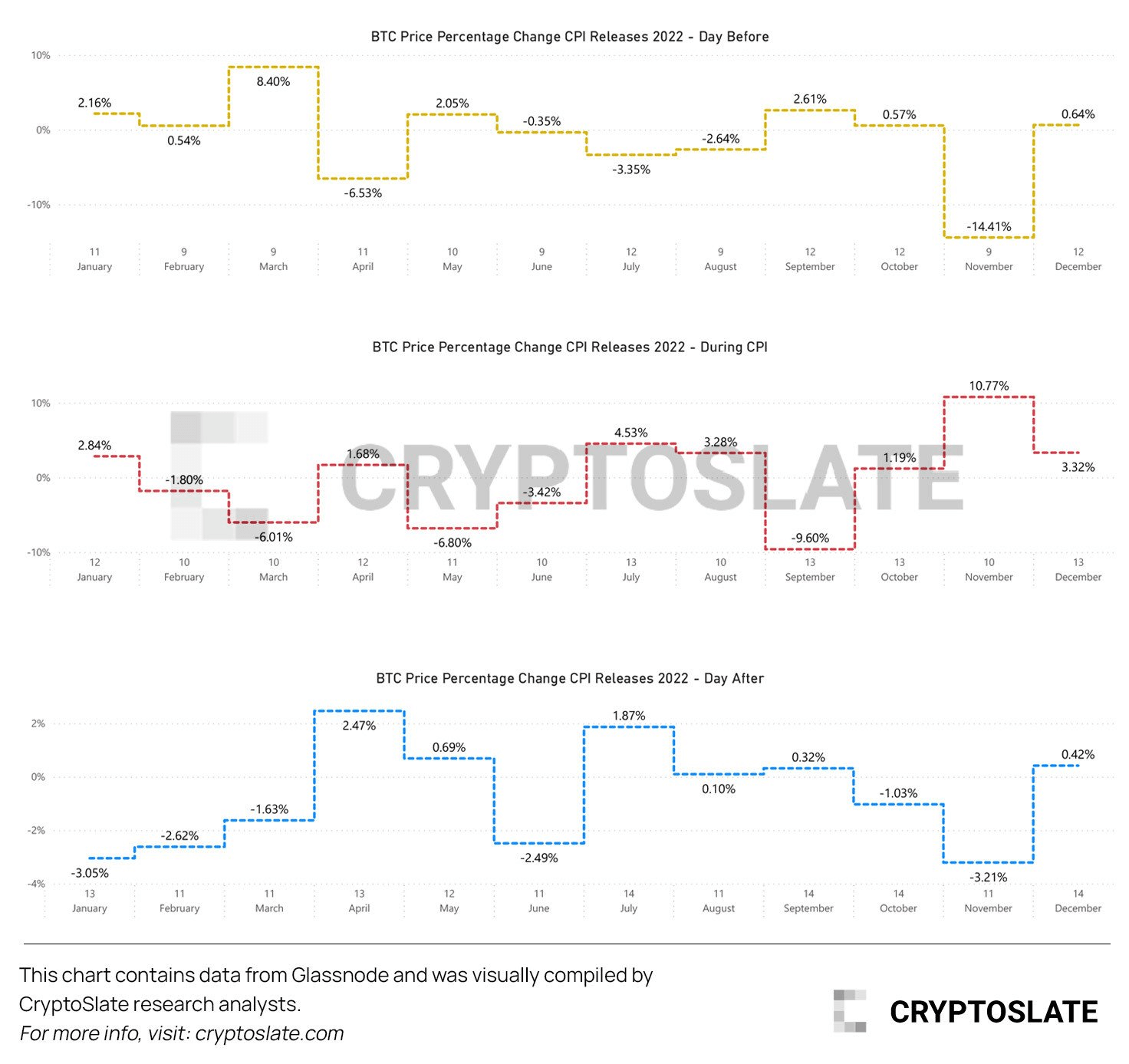

The chart below shows approximately half positive and half adverse effects on the Bitcoin price before the CPI announcement; this was also the case during the announcement.

By contrast, the day after the announcement tended to yield mostly adverse price effects, presumably as investors have had time to absorb the reality of elevated consumer prices and the subsequent continuation of interest rate hikes.

Separating the three categories of “Day Before, “During CPI,” and “Day After” into individual percentage change charts better depicts the previously stated findings.

Based on these patterns, there is no significant directional likelihood either before or during the CPI announcement. However, it is expected that Bitcoin will trend lower post-announcement.

Growing signs of stagflation

There is increasing evidence of stagflation, despite denials of a recession at the present time, including the White House redefinition of what constitutes a recession.

Stagflation refers to a combination of high inflation and economic stagnation, particularly high unemployment. This presents policymakers with a dilemma, in that measures to lower inflation could aggravate unemployment.

A recent article by Peter Schiff blamed our current economic woes on “those stimmy checks” triggering inflation, which has since morphed into stagflation. He pointed out that government spending, one way or another, must be paid for by the public.

Further, quoting work by Spanish Economist Daniel Lacalle, the article mentioned the reality of weaker growth trends, rising taxes, and severe inflation, particularly in respect…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…