Bitcoin (BTC) price jumped to $17,500 on Jan. 11, driving it to its highest level in three weeks. The price move gave bulls control of the $275 million BTC weekly options expiry on Jan. 13 because bears had placed bets at $16,500 and lower.

The recent move has perma-bulls and dip buyers calling a market bottom and potential end to the bear market but what does the data actually show?

Is the Bitcoin bear market over?

It might seem too pessimistic to say right now, but Bitcoin did trade below the $16,500 level on Dec. 30 and those bearish bets are unlikely to pay off as the options deadline approaches.

Investors’ main hope is the possibility of the U.S. Federal Reserve halting its interest rate increase in the first quarter of 2023. The Consumer Price Index (CPI) inflation report will be released on Jan. 12 and it might give a hint on whether the central bank’s effort to slow the economy and bring down inflation is achieving its expected results.

Meanwhile, crypto traders fear that an eventual downturn in the traditional markets could cause Bitcoin to retest the $15,500 low. For instance, Morgan Stanley’s CIO and chief U.S. equity strategist, Mike Wilson, told investors on CNBC to brace for a winter downdraft and warned that the S&P 500 index is vulnerable to a 23% drop to 3,000. Wilson added: “Even though a majority of institutional clients think we’re probably going to be in a recession, they don’t seem to be afraid of it. That’s just a big disconnect.”

Bitcoin bears were not expecting the rally to $17,500

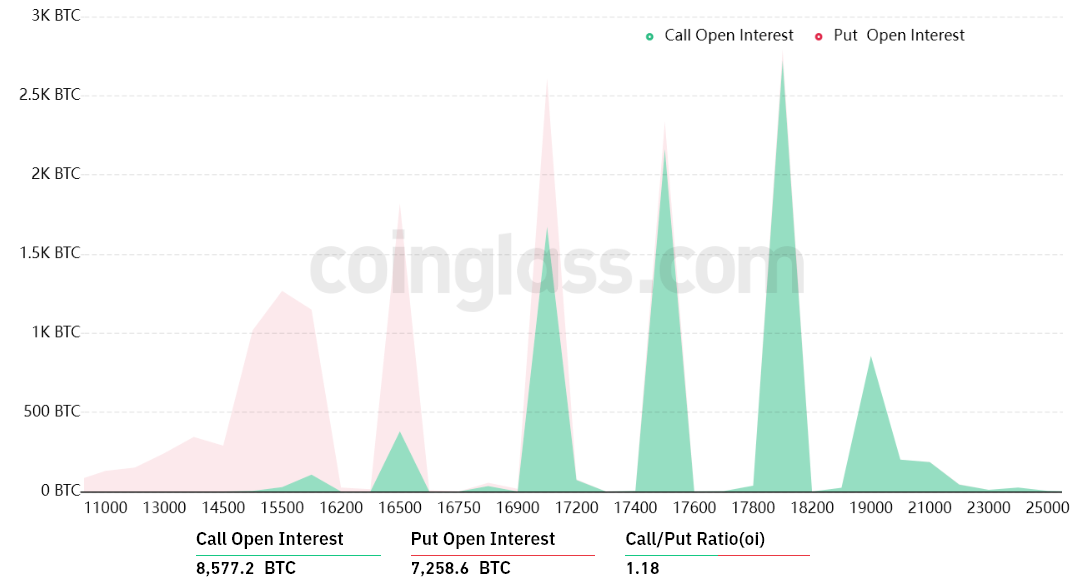

The open interest for the Jan. 13 options expiry is $275 million, but the actual figure will be lower since bears were expecting prices below $16,500. Bulls seem in complete control, even though their payout becomes much larger at $18,000 and higher.

The 1.18 call-to-put ratio reflects the imbalance between the $150 million call (buy) open interest and the $125 million put (sell) options. If Bitcoin’s price remains above $17,000 at 8:00 am UTC on Jan. 13, less than $2 million worth of these put (sell) options will be available. This difference happens because the right to sell Bitcoin at $16,500 or $15,500 is useless if BTC trades above that level on expiry.

$18,000 Bitcoin will give bulls a $130 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on Jan. 13 for call (bull) and put…

Click Here to Read the Full Original Article at Cointelegraph.com News…