Bitcoin (BTC) is trading at its lowest since mid-December 2020 on June 13, but the bottom could be anywhere.

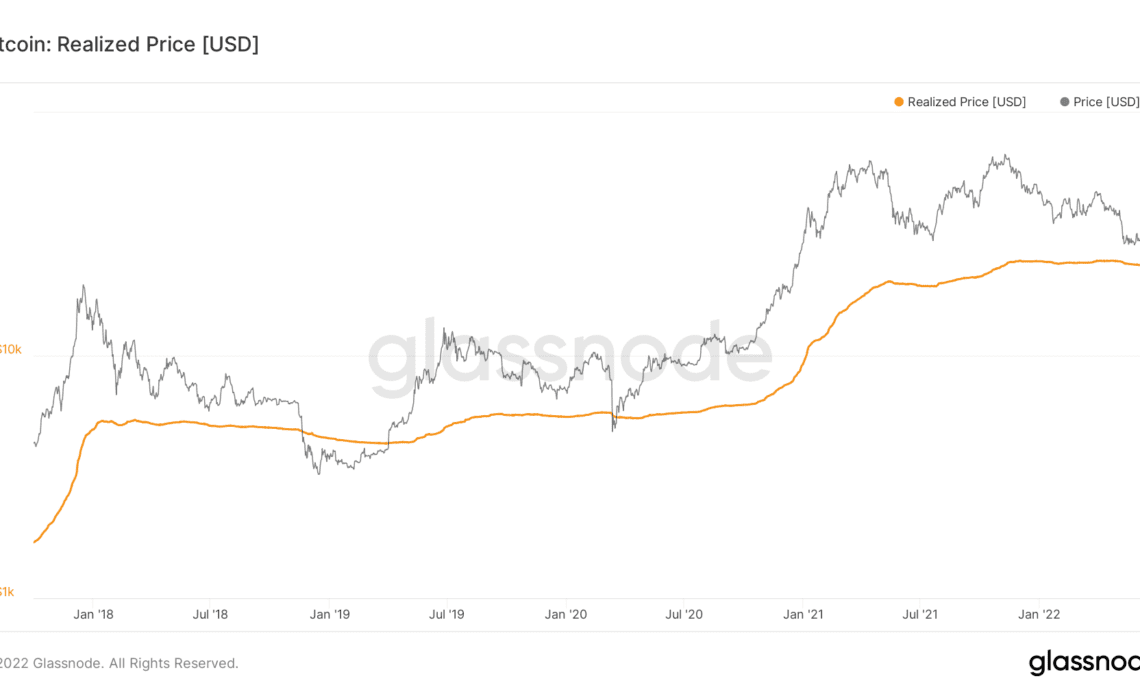

As the weekend sell-off intensifies, BTC/USD has now broken below its realized price for the first time since March 2020, data from Cointelegraph Markets Pro and TradingView confirms.

Bitcoin clings to realized price

At around $23,400, realized price — the average price at which each BTC last moved — is acting as the first solid support so far on lower timeframes.

Previous levels, including those highlighted as potential bottoms, have failed to hold, and sentiment continues to favor further sell-side pressure thanks to the Celsius aftermath, inflation and forthcoming actions by the United States Federal Reserve.

Where BTC/USD could put in a final macro floor, meanwhile, is now a topic of heated debate.

The first port of call for a significant drawdown is the 200-week simple moving average (200 SMA), traders and analysts agree.

At $22,370 as of June 13, the 200 SMA has acted as key support throughout Bitcoin’s lifetime, with only brief wicks below it marking generational spot price bottoms.

The 200 SMA has in addition never broken its own uptrend, and the hope is that reaching it will allow bulls at least a period of respite.

“People are looking to buy there, it’s going to bounce more than likely at that area,” Josh Rager argued in a dedicated video update on the day.

While describing the bounce at the 200 SMA as a “self-fulfilling prophecy” thanks to the scope of interest in it, he warned that there was guarantee that BTC/USD would not continue south this time around.

This is thanks to historical precedent, which shows Bitcoin bottoming out up to 84% below its latest all-time high. At $69,000, such a bottom would thus lie at just $11,000.

“That would be detrimental; I don’t think the price drops that low, I mean you’re basically looking at a full retrace of the entire bull market and we have never seen that,” Rager continued.

Instead, areas of interest are the 2017 all-time high around $20,000, as well as the area immediately below, extending to $17,000. $14,000, equating to an 80% retracement from the current all-time highs, is also worth paying attention to, he added.

As Cointelegraph reported, several of those levels have already been underscored by others as potential bottoms, among them by trader and analyst Rekt…

Click Here to Read the Full Original Article at Cointelegraph.com News…