Bitcoin (BTC) price broke above $22,500 on Jan. 20 and has since been able to defend that level, accumulating 40.5% gains in the month of January. The move accompanied improvements in the stock market, which also rallied after China dropped COVID-19 restrictions after three years of strict pandemic controls.

E-commerce and entertainment companies lead as the year-to-date market performers. Warner Bros (WBD) added 54%, Shopify (SHOP) rose 42%, MercadoLibre (MELI) climbed 41%, Carnival Corp (CCL) 35% and Paramount Global (PARA) managed a 35% gain so far. Corporate earnings continue to attract investors’ inflow and attention after oil producer Chevron posted the second-largest annual profit ever recorded, at $36.5 billion.

More importantly, analysts expect Apple (AAPL) to post a mind-boggling $96 billion in earnings for 2022 on Feb. 2, vastly surpassing the $67.4 billion profit that Microsoft (MSFT) reported. Strong earnings also help to validate the current stock valuations, but they do not necessarily guarantee a brighter future for the economy.

A more favorable scenario for risk assets came largely from a decline in leading economic indicators, including homebuilder surveys, trucking surveys and contracting Purchasing Managers Index (PMI) data, according to Evercore ISI’s senior managing director, Julian Emanuel.

According to the research from financial services firm Matrixport, American institutional investors represent some 85% of recent purchasing activity. This means large players are “not giving up on crypto.” The study considers the returns occurring during U.S. trading hours but expects the outperformance of altcoins relative to Bitcoin.

From one side, Bitcoin bulls have reasons to celebrate after its price recovered 49% from the $15,500 low on Nov. 21, but bears still have the upper hand on a larger time frame since BTC is down 39% in 12 months.

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioned in the current market conditions.

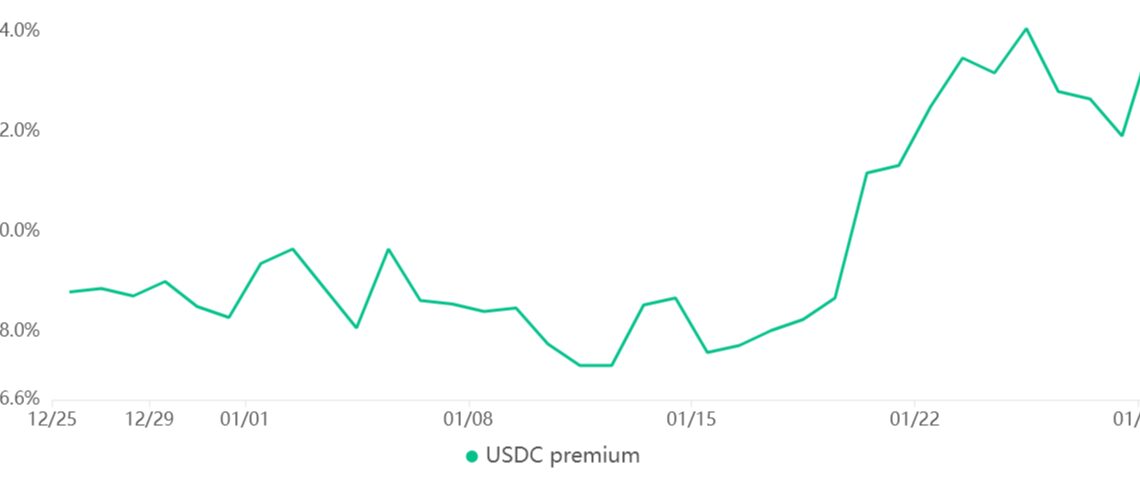

Asia-based stablecoin demand approaches the FOMO region

The USD Coin (USDC) premium is a good gauge of China-based crypto retail trader demand. It measures the difference between China-based peer-to-peer trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, the stablecoin’s market offer is flooded, causing a 4% or higher discount.

Click Here to Read the Full Original Article at Cointelegraph.com News…