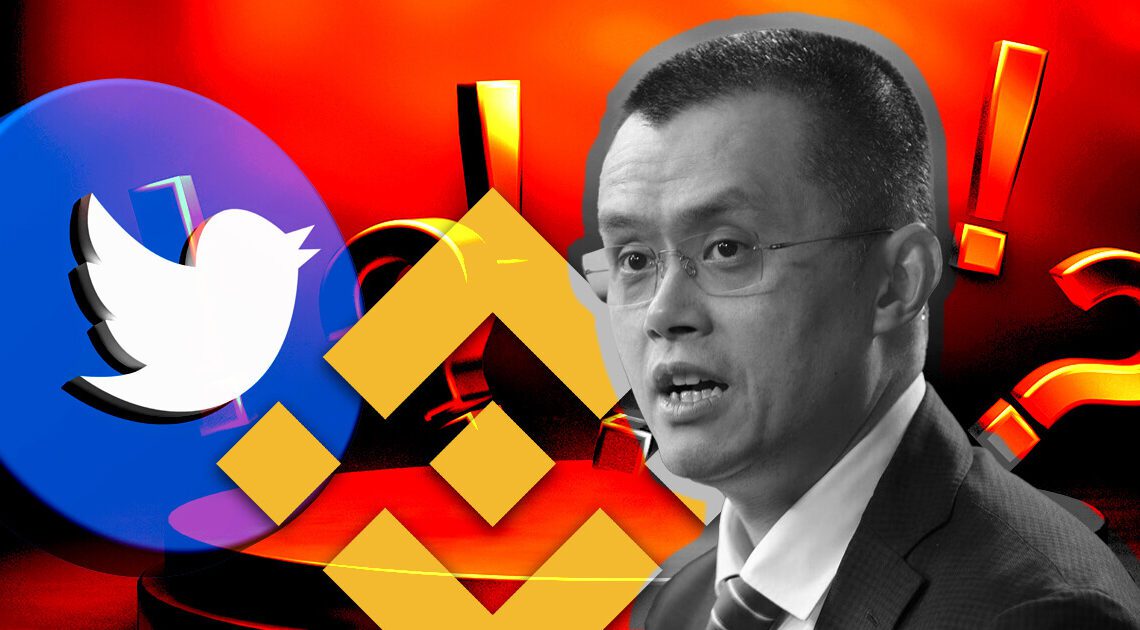

Binance CEO Changpeng Zhao (CZ) said that stablecoin regulation could help accelerate its adoption, according to a Feb. 1 Twitter thread.

CZ pointed out that stablecoins are under strong regulatory focus and their regulation would “bring much-needed certainty to issuers, users, and service providers.”

Stablecoins have faced increased scrutiny over the past year following the collapse of Terra’s algorithmic stablecoin UST. Financial regulators have highlighted the dangers the asset class poses to the broader financial system and have increased their regulatory efforts around the space.

CZ noted that we are already seeing the benefits and use cases of stablecoins in “cross-border payments, hedging against inflation, and even aid disbursement.”

CZ praises Hong Kong’s “decided approach”

The Binance CEO praised the Hong Kong government’s “decided approach to stablecoins.”

CZ highlighted that Hong Kong’s approach will provide “a more defined scope for regulated activities, specifically governance, issuance, stabilization arrangements, and wallets – including access and holdings management.” He added that:

“[The] Adoption of a risk-based approach to decide which stablecoins are in scope, aiming to mitigate risk to monetary & financial systems – thus starting with fiat-backed.”

CZ said he “fully supports” the requirements for 1:1 backing and redemption at par while touting his exchange’s stablecoin BinanceUSD (BUSD).

The Hong Kong Monetary Authority (HKMA) recently published its regulatory plans that required stablecoin issuers to get licensed and prevented the proliferation of algorithmic stablecoins. HKMA said:

“Stablecoins that derive their value based on arbitrage or algorithm will not be accepted. Stablecoin holders should be able to redeem the stablecoins into the referenced fiat currency at par within a reasonable period.”

Over the past year, the Asian country, alongside the U.S., the European Union, Singapore, and Japan, have introduced various regulatory measures to prevent another Terra-like collapse.

Meanwhile, CZ said he was looking forward to the proposals of the Monetary Authority of Singapore (MAS) and the international financial body, the Financial Stability Board (FSB).

Click Here to Read the Full Original Article at Stablecoins News | CryptoSlate…