The new year began with the news that notable Web3 entrepreneur Kevin Rose fell victim to a phishing scam in which he lost over $1 million worth of nonfungible tokens (NFTs).

As mainstream financial institutions begin to provide services related to Web3, crypto and NFTs, they would be custodians of client assets. They must protect their clients from bad actors and identify whether client assets have been obtained through illicit activities.

The crypto industry hasn’t made it easy for Anti-Money Laundering (AML) functions within organizations. The sector has innovated constructs like cross-chain bridges, mixers and privacy chains, which hackers and crypto thieves can use to obfuscate stolen assets. Very few technical tools or frameworks can help navigate this rabbit hole.

Regulators have recently come down hard on some crypto platforms, pressuring centralized exchanges to delist privacy tokens. In August 2022, Dutch police arrested Tornado Cash developer Alexey Pertsev, and they have worked on controlling transactions through mixers since then.

While centralized governance is considered antithetical to the Web3 ethos, the pendulum may have to swing in the other direction before reaching a balanced middle ground that protects users and doesn’t curtail innovation.

And while large institutions and banks have to grapple with the technological complexities of Web3 to provide digital assets services to their clients, they will only be able to provide suitable customer protection if they have a robust AML framework.

AML frameworks will need several capabilities that banks must evaluate and build. These capabilities could be built in-house or achieved by collaborating with third-party solutions.

A few vendors in this space are Solidus Labs, Moralis, Cipher Blade, Elliptic, Quantumstamp, TRM Labs, Crystal Chain and Chainalysis. These firms are focused on delivering holistic (full-stack) AML frameworks to banks and financial institutions.

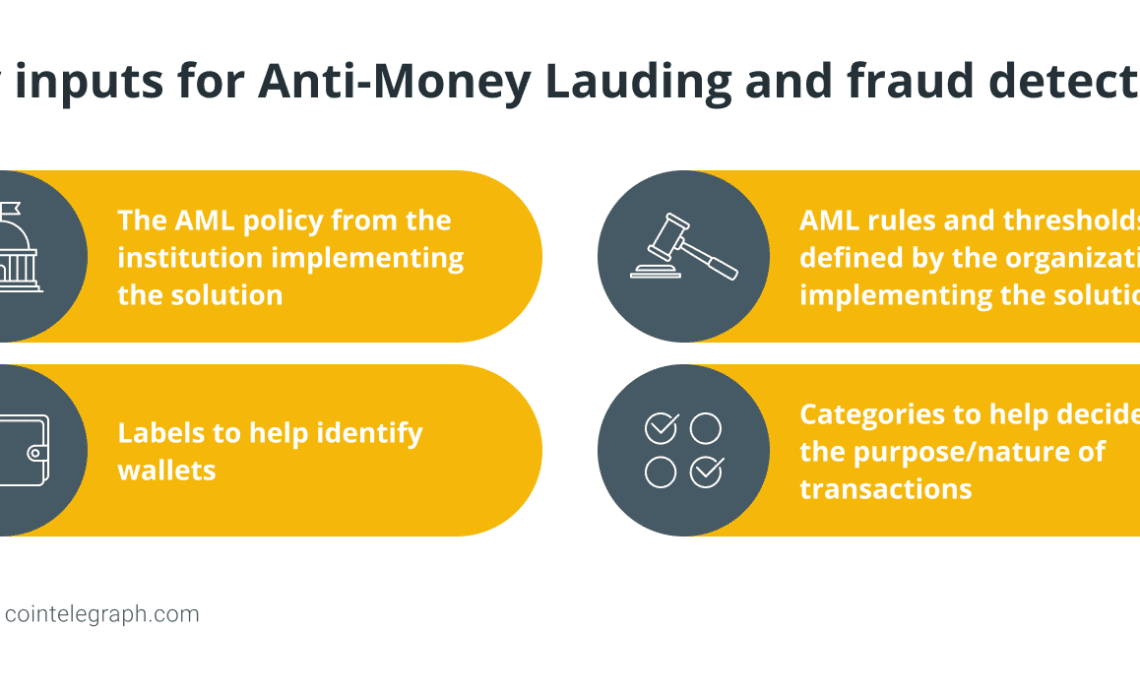

For these vendor platforms to deliver a holistic approach to AML around digital assets, they must have several inputs. The vendor provides several of these, while others are sourced from the bank or institution they work with.

Data sources and inputs

Institutions need a ton of data from varied sources to effectively identify AML risks. The breadth and depth of data an institution can access will decide the effectiveness of its AML function. Some of the key inputs needed for AML and fraud detection are below.

The AML policy is…

Click Here to Read the Full Original Article at Cointelegraph.com News…