Ethereum price (ETH) gained 10.2% from Jan. 4 to Jan. 10, breaching the $1,300 resistance without much effort, but has the Ether price move cast a light on whether the altcoin is ready to begin a new uptrend.

Will Ethereum’s former resistance level turn to support?

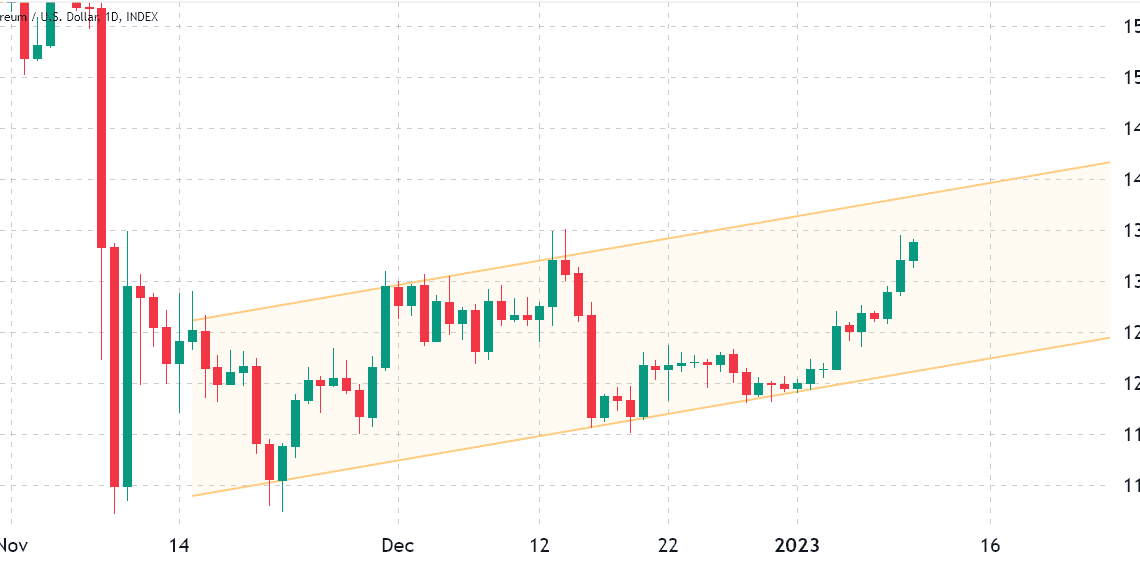

After testing the $1,200 support on Jan. 1, the eight-week ascending channel has displayed strength, but Ether bulls fear that negative newsflow might break the pattern to the downside.

Despite the positive price trend, the sentiment around Ethereum and other cryptocurrencies hasn’t been very enticing. For example, on Jan. 8, Xiao Yi, the former Chinese Communist Party secretary of Fuzhou, confessed to “acting recklessly” in support of crypto mining. Xiao seemed to speak from what appeared to be a prison, apologizing for causing “grave losses” to the Fuzhou region.

On Jan. 10, South Korean tax agents reportedly raided Bithumb’s exchange offices to explore a potential tax evasion case. On Dec. 30, Park Mo — an executive at Bithumb’s parent company — was found dead, though he was under investigation for embezzlement and stock price manipulation.

This week (Jan. 10), Cameron Winklevoss, the co-founder of the Gemini exchange, issued an open letter to Barry Silbert, CEO of Digital Currency Group (DCG). In the letter Winklevoss makes some serious fraud accusations and requests that the Grayscale fund management holding company dismiss Silbert to provide a resolution for Gemini’s Earn users.

The ongoing crypto winter left another scar on Jan. 10 as the U.S. leading cryptocurrency exchange Coinbase announced a second round of layoffs, impacting 20% of the workforce.

However, the exchange’s CEO, Brian Armstrong, tried to minimize the damage by stating that Coinbase remains “well capitalized” and he attempted to tranquilize investors with business-as-usual messages.

Consequently, some investors believe Ether could revisit prices below $600 as fear remains the prevalent sentiment. For instance, trader Crypto Tony expects the current triangle formation to cause another “leg down later this year.”

Unless we take out $2,200 on the macro level I am treating this as consolidation for a B or X wave, before we get one more leg down later this year

Volume is contracting and I also expect this to dwindle down lower. Pay attention pic.twitter.com/LTik7GXEYa

— Crypto Tony (@CryptoTony__) January 10, 2023

Let’s look at Ether derivatives data…

Click Here to Read the Full Original Article at Cointelegraph.com News…