According to on-chain data, the net value of Ethereum removed from staking has surpassed $1 billion in value over the past 24 hours, yet again showcasing the network’s ability to perform live network-wide updates without issue.

ETH withdrawals in action

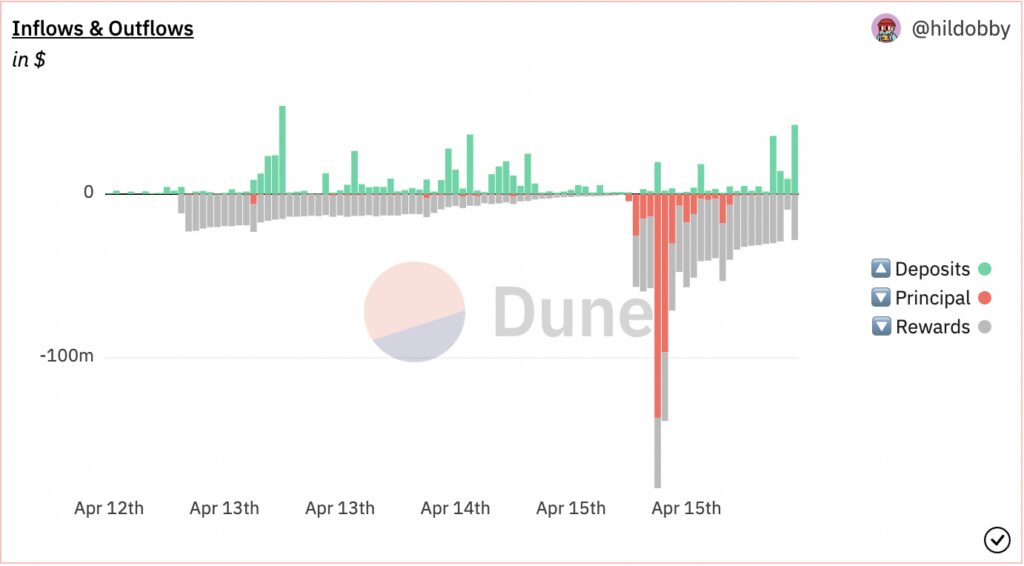

A total of $1.7 billion has been withdrawn since the Shanghai and Capella upgrades went live. However, as round 2 of withdrawals began, the value of Ethereum withdrawn increased. Round 1 took 4.14 days to complete as validators in the queue were processed.

18,442,455 ETH is currently staked, with a value of $38.5 billion as of press time. As a result,

staked ETH makes up 15.32% of the total supply, with 33% staked with Lido.

With withdrawals now open, investors have been withdrawing their initial capital and the earned rewards. Staked Ethereum earns interest over time, and when a validator earns over 32 ETH through rewards, the excess amount does not add to their principal. Instead, it gets withdrawn automatically as a reward payment every few days.

The chart below shows the vast difference between deposits and withdrawals (rewards and principal funds) since the upgrade.

Rewards

Staking rewards began around 15% and were put on a predefined falling curve relative to the number of validator participants until the Merge when the network took over. The current validator reward is 4.33%, including consensus rewards and transaction fees. These rewards spiked to around 5.2% in the days leading up to the upgrade but have since returned to their downward trajectory. Total staking rewards have fallen by 1.4% since the Merge last September when they jumped to 5.8% from 4.3%.

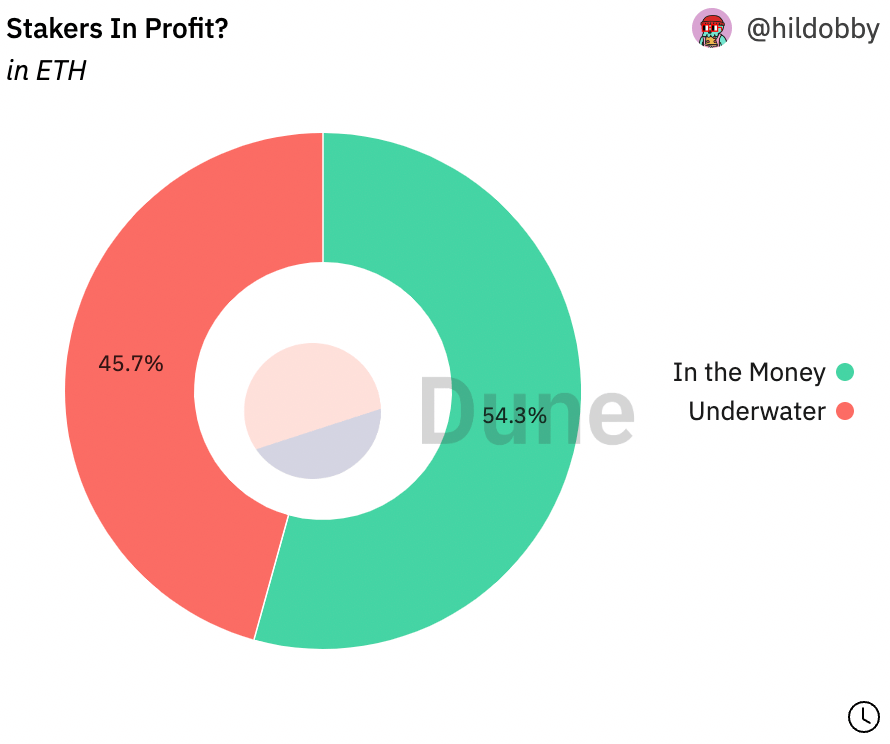

In addition to the change in deposits, withdrawals, and rewards, the average value of Ethereum staked with validators has reduced since withdrawals opened. As a result, 54.3% of stakers are now in profit with ETH around $2,000.

Bullish momentum

Ultimately, both the Shanghai and Capella upgrades appear to have been a success,…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…